I have had a long break and will now again make a sincere effort to start and be regular on the blog once again. The markets once again are in a state of flux and moving just to sort out the trader. I am confident and do maintain that India is a wonderful investing opportunity and those who invest here as investors for the next 10 odd years (I repeat ‘INVESTORS’) – they are likely to reap phenomenal benefits in the years to come. The snapshot that I have posted to the left is trend channel that we are into and as long as the basic channel is not broken on the downside – apart from some corrections – the uptrend is intact. Infact if one would have noticed – there had been a talk of correction for a very long time – and now that we are so near the top of the channel – there is a talk of continued uptrend. Like I said the uptrend on a longer term perspective is unquestionable but on the short term – a small correction is very much in offing. Now whether it happens today or after a few days – it will be known in coming weeks (if not next week itself). My only hope is that we all should be on the right side of the market when this happens.

I have had a long break and will now again make a sincere effort to start and be regular on the blog once again. The markets once again are in a state of flux and moving just to sort out the trader. I am confident and do maintain that India is a wonderful investing opportunity and those who invest here as investors for the next 10 odd years (I repeat ‘INVESTORS’) – they are likely to reap phenomenal benefits in the years to come. The snapshot that I have posted to the left is trend channel that we are into and as long as the basic channel is not broken on the downside – apart from some corrections – the uptrend is intact. Infact if one would have noticed – there had been a talk of correction for a very long time – and now that we are so near the top of the channel – there is a talk of continued uptrend. Like I said the uptrend on a longer term perspective is unquestionable but on the short term – a small correction is very much in offing. Now whether it happens today or after a few days – it will be known in coming weeks (if not next week itself). My only hope is that we all should be on the right side of the market when this happens.

The last trading day of the week ended with DOW down 0.20%, Nasdaq down 0.20% and S&P down 0.37%. Europe fared even worse with FTSE down 0.62%, Dax down 1.17% and CAC down 1.28%. Asia was mixed with Nikkei down 0.12%, Hang Seng up 0.59% and Strait Times down 0.39%. It may not exactly give strength for us to open on Monday – may be another flattish opening.

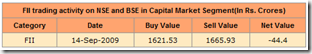

Now that we have this basic in our minds – let us see what the technical's tell us. Firstly the FIIs have been buying for some time now – and I only hope that they do not decide to pull out some profits.

Now that we have this basic in our minds – let us see what the technical's tell us. Firstly the FIIs have been buying for some time now – and I only hope that they do not decide to pull out some profits.

Let us see the option data.  Firstly the put build up is huge and may prevent a real fall that so many are expecting – but then unwinding can take place pretty fast. The levels at which the put build up is there is 81 lacs at 5400 level and 99.72 lacs at 5300 levels. So support at 5300 should be good. As far as the call build up is concerned – the call build up is 86 lacs at 5600 levels and 75 lacs at 5500 levels. So the market perhaps is laying down a range 5300 to 5600. It is perhaps too early to see option pain – but all the same the worst would be market ending at 5400 level as per option pain.

Firstly the put build up is huge and may prevent a real fall that so many are expecting – but then unwinding can take place pretty fast. The levels at which the put build up is there is 81 lacs at 5400 level and 99.72 lacs at 5300 levels. So support at 5300 should be good. As far as the call build up is concerned – the call build up is 86 lacs at 5600 levels and 75 lacs at 5500 levels. So the market perhaps is laying down a range 5300 to 5600. It is perhaps too early to see option pain – but all the same the worst would be market ending at 5400 level as per option pain.

Let start no with the charts, ADX is saying that we are not trending – so to take a particular directional call may not be a very good idea, however if at all the signals ae indicating long as far as we remain above 5414. The PSAR too is indicating long as of now – but I would like to rub in we are at the upper end of the channel and a correction can be in the offing. RSI is bullish, ADX is bearish indicating a weak trend. MACD is bearish – but just so. Slow Stochastics are overbought.  Bollinger bands have contracted and the candles are trailing upper Bollinger bands – so chances are the markets will first correct to middle Bollinger bands to 5318. The volumes in Nifty Futures have been 116% the average. Interestingly the IFCI fell on 5% + on 249% of average volumes – if it does not bounce back on Monday then we may see lower levels.

Bollinger bands have contracted and the candles are trailing upper Bollinger bands – so chances are the markets will first correct to middle Bollinger bands to 5318. The volumes in Nifty Futures have been 116% the average. Interestingly the IFCI fell on 5% + on 249% of average volumes – if it does not bounce back on Monday then we may see lower levels.

So now to summarise – the medium to long term trend remains up – but for the immediate future there may be some downside – and infact that can be healthy for the markets to continue upwards. The low level that can be expected are 4925 levels. Best of luck for Monday…