Before I start let me share the wonder of night with you. Well it is 1:30 AM and the moon is up. The weather is beautiful and romantic to say the least. The moonlight and smell of distant rain, the vast open space of the airport can make any one a poet at this time of the day. Standing out I relive my time as a college student – that running out of the house after midnight and roaming the streets of Chandigarh. The beauty of life, the beauty of GOD’s creating – WOW. I came back to the office and started off with writing this article – and as I pen down these words – I get distracted off and on to take a small stroll out. What am I doing up at this time? well I have a sortie and that is scheduled at 0300 hrs and I am waiting my turn. Another one and a half hours to go.

The markets were beautiful and the predicted third white candle is standing tall inspite of a negative predictions by many. Well frankly – given a chance I would have happily skipped today’s update as the indications now are so conflicting that to take a call for tomorrow may be more like flipping a coin than anything else. More of it when I come to the candles. The Global cues meanwhile are also giving signs of taking a breather. In Asia the Nikkei closed up 1.78%, Hang Seng up 3.6% and Strait Times up 0.56%. The Europe too kept the steam and spirits up by FTSE clocking 2.94% up, DAX 2.3% up and CAC 3.18% up in green. It is US that has shown the signs of the upswing tapering off – DOW opened flat – immediately starting climbing and continued its rally to impressive almost 200 point up then after the mid session came tumbling down to close 0.10% in red. Nasdaq too closed 1.92% in red and S&P closed 0.35% in red. It would be interesting to see the opening of Asia in few hours as it is likely to dictate where we open and how we behave.

As far as the candle are concerned – ideally three strong standing white candles do signal the continuation of the uptrend. This uptrend has actually already taken us above the mid way of Bollinger bands. The Bolliner Bands have started contracting and if we go on to the upper edge of the Bollinger bands then we hit somewhere just short of the 2900 mark – that is if all go well. The volumes were ditto of day before. on ADX DI+ has gone above the DI- but the red flag is the DX line turning down. If it continues this way then there is a danger of negative divergence building up. 5 EMA is just short of crossing over 20 EMA and I am keeping my fingers crossed. IF we do cross this then definitely the 5 EMA will attempt kissing the 50 EMA also. MACD is showing a positive divergence. RSI looks up. The %K line of Slow Stochastics (for the analysts)/red line for others has already reached the overbought zone. As the medium term trend is still down – we may see the markets green only for one odd day more before the trend reverses or the market consolidates. The TRIX has started to look up and that is a good development to say the least.

As far as the markets trending today was concerned – let us see the charts.

The levels for tomorrow are: -

R3 2861 as compared to 2718 yesterday

R2 2833

R1 2805

Pivot 2753 as compared to 2612 yesterday

S1 2725

S2 2673

S3 2645 as compared to 2506 yesterday

Projected High Range 2779 to 2819

Projected Low Range 2743 to 2703

Fib Projected High 2802

Fib Projected Low 2679

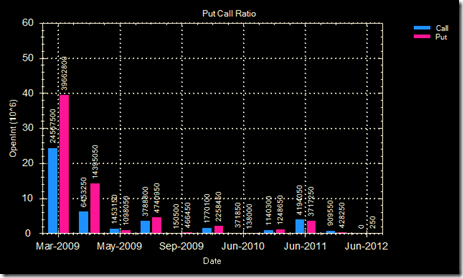

Its time for me to go for flying and I will pen off now. and before I go here are the options data. See the build up of puts…

2 comments:

Gotta say thank you for the well rsearched posts!

- Uma

Thanks Uma - atleast someone visibly appreciates what I do.

cheers

;-D

Post a Comment