Let me put my life in the stock markets this way – I was an average Indian who got a job and was told that you must now save for the future. I did so – contributing some in Provident fund, other in FDs etc. This did not wet my appetite so I started of with the Stocks and those schemes of the yesteryears – double your money in six months. Well that six months – double your money schemes were outright steal so I took a chance – lost there then there were those schemes of Teak tree plantations… the list really goes on and on and they are endless. The stocks also had their ups and downs – Harshad Mehta, Parekh, IT Boom and 2008 were the other ups and downs that some times took money away and at other times gave some. In all the balance sheet was favourably tilted always in favour of FDs and Provident funds – but the lure of “Little More” made the money to be siphoned off from the safe to unsafe investments to stocks. Now it is not that I never made money from the stocks – I did make money when I bought the stocks – kept identifying and buying over a period of time and those accumulated stocks were kept with me for a reasonable period of time. In the yesteryears – that was no problem – there were delivery of stocks that took months by a normal stock broker – then was the actual transfer of shares – transfer deeds – mis-matched signatures and to top it all postings to far flung areas with no brokers, no communications... and so forth. The stocks by default would be held for a long time – and many a times forgotten – to be discovered one day – either ten times the cost or – no longer being traded. But yes there was money to be made. Then came the change – online trading, penetration of the net, and demat accounts. – here the trigger was always in your hands. This in my mind – created far more problems – I could never keep the stocks long enough to make money. I did all the stupid things in the book to loose money. Then came the bigger caveat – futures and options – and that was the time that the lure of more made me loose more than what I saved.

Let me put my life in the stock markets this way – I was an average Indian who got a job and was told that you must now save for the future. I did so – contributing some in Provident fund, other in FDs etc. This did not wet my appetite so I started of with the Stocks and those schemes of the yesteryears – double your money in six months. Well that six months – double your money schemes were outright steal so I took a chance – lost there then there were those schemes of Teak tree plantations… the list really goes on and on and they are endless. The stocks also had their ups and downs – Harshad Mehta, Parekh, IT Boom and 2008 were the other ups and downs that some times took money away and at other times gave some. In all the balance sheet was favourably tilted always in favour of FDs and Provident funds – but the lure of “Little More” made the money to be siphoned off from the safe to unsafe investments to stocks. Now it is not that I never made money from the stocks – I did make money when I bought the stocks – kept identifying and buying over a period of time and those accumulated stocks were kept with me for a reasonable period of time. In the yesteryears – that was no problem – there were delivery of stocks that took months by a normal stock broker – then was the actual transfer of shares – transfer deeds – mis-matched signatures and to top it all postings to far flung areas with no brokers, no communications... and so forth. The stocks by default would be held for a long time – and many a times forgotten – to be discovered one day – either ten times the cost or – no longer being traded. But yes there was money to be made. Then came the change – online trading, penetration of the net, and demat accounts. – here the trigger was always in your hands. This in my mind – created far more problems – I could never keep the stocks long enough to make money. I did all the stupid things in the book to loose money. Then came the bigger caveat – futures and options – and that was the time that the lure of more made me loose more than what I saved.

After travelling this full circle – I am educating myself as now how to make some more money the intelligent way. Frankly I might have not made much but at every stage I can look back and am ready to pull out some more out of the system – and this is my journey to the Painful rebirth. I am sure that any reasonable stock of reasonable Pedigree in your portfolio held for a reasonable period of time will mature and bear you fruits. The underline is Reasonable Stock, Reasonable Pedigree and Reasonable Period. No other investments can perhaps give you as much with as much ease. But all these reasonable assumptions have to be kept in mind.

After travelling this full circle – I am educating myself as now how to make some more money the intelligent way. Frankly I might have not made much but at every stage I can look back and am ready to pull out some more out of the system – and this is my journey to the Painful rebirth. I am sure that any reasonable stock of reasonable Pedigree in your portfolio held for a reasonable period of time will mature and bear you fruits. The underline is Reasonable Stock, Reasonable Pedigree and Reasonable Period. No other investments can perhaps give you as much with as much ease. But all these reasonable assumptions have to be kept in mind.

The Markets at the moment are buoyant and everyone who is holding stock is basking in the glory of good returns. All the indicators are at the moment good except some of those that are ringing some bells of dissent. These are the ones in the overbought territory. The other is like the results of reliance that were not up to the mark. Poor infact, but to me what is likely to happen is that the reliance will loose grip over the market shakers and movers spot and will be replaced by someone else. It could be power, Infra, Oil and Gas sector. IT, Cement, Communication – their times are not as rocking. It would be good if someone can bet on the Dark horse today – and in the days to come as the turnover is about to happen. As far as the Global cues are concerned – Asia was rocking – Nikkei closed in green by 1.55%, Hang Seng up 0.83% and Strait Times up 1.92%. There were spots of weakness when it seemed that the markets that had opened green will not hold up but they did and closed comfortably green. As far as the Europe is concerned – FTSE was red – went green and lost ground again but still managed to hold its head above the water. It closed 0.37% in green. Dax closed in red – down 0.34% and so did CAC close – down in red 0.22%. US was a mixed bag with not so good cues – Dow up barely 0.26%, Nasdaq in red 0.39% and S&P in green 0.3%. The markets overall had a good week with the S&P closing the week up 4.1%.

As far as the candles are concerned the candles still are white they are just short of trailing the upper Bollinger bands and Bollinger Bands are expanding – the upswing can continue. Without exception the lower EMAs are above the Higher EMAs and the signs on this account too are bullish to say the least. The Volumes are 96% of the last 50 Day average. ADX is bullish and at a figure of 32.53. ADX at 19 indicating an extremely weak trend (the one going up that is!) so be careful on that account. MACD is bullish with increasing bullish divergence. RSI is bullish. Slow Stochastic is overbought but bullish. So all in all – most of the indicators are bullish with exception of ADX.

As far as the options are concerned the nifty put build up is so much that it would be extremely difficult for the nifty to fall this expiry without taking out a lot of put writers. So as far as the nifty options data is concerned there is a bright chance that the nifty will be kept range bound for this expiry and then the bulls will remove their hands from the markets after 02 Aug. Well that is my supposition and I also feel that if the markets do fall (because of the reliance results or whatever) then and the markets make the put writers run for cover then the fall will be extremely sharp and can surprise al lot out the bulls out of the present run up.

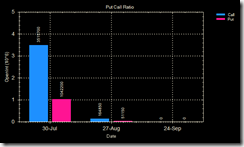

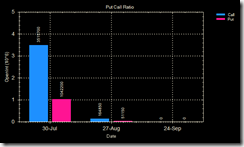

As far as the options are concerned the nifty put build up is so much that it would be extremely difficult for the nifty to fall this expiry without taking out a lot of put writers. So as far as the nifty options data is concerned there is a bright chance that the nifty will be kept range bound for this expiry and then the bulls will remove their hands from the markets after 02 Aug. Well that is my supposition and I also feel that if the markets do fall (because of the reliance results or whatever) then and the markets make the put writers run for cover then the fall will be extremely sharp and can surprise al lot out the bulls out of the present run up.  The put call ratio is to the tune of 1.5+ on the other hand the call build up in reliance is extremely high and the reverse should be true ideally. In these charts the blue is the calls and the red are the puts.The chart on the left is of nifty and right is the one of reliance. Now here is the dichotomy – does it not mean that if reliance falls – the entire markets too will fall. – so ideally if the put writers have to save themselves then they have to keep reliance at about these levels – if the reliance call writers have to protect themselves then they have to ensure that the reliance does not run up. What and interesting fight we are to see this coming week!

The put call ratio is to the tune of 1.5+ on the other hand the call build up in reliance is extremely high and the reverse should be true ideally. In these charts the blue is the calls and the red are the puts.The chart on the left is of nifty and right is the one of reliance. Now here is the dichotomy – does it not mean that if reliance falls – the entire markets too will fall. – so ideally if the put writers have to save themselves then they have to keep reliance at about these levels – if the reliance call writers have to protect themselves then they have to ensure that the reliance does not run up. What and interesting fight we are to see this coming week!

Overall the global cues may not be as supporting the bulls as in the past month. The technicals on the other hand remain fairly bullish with an eye on ADX and overbought Slow Stochastic. The options index data too supports bullish. Ideal strategy should be to hold longs. With stoploss of 4430 and those brave enough to be holding shorts till now – the absolute stoploss should be 4556 on closing basis. For intraday be short below 4497 and go long above it. Hope you have a good trading day on Monday.

1 comments:

Your story of dealing in stocks is true for many more. Any way it is never too late to learn from the past and proceed.

Post a Comment