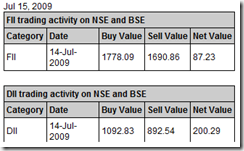

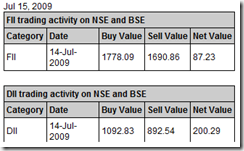

I love us – Indians. There seems to be no normal way to do the things. It goes without saying that the bounce was expected – but then like everything Indian – we tend to overdo.  Sell like the heavens are falling and buy like there is no tomorrow. And yes the markets went overboard. Now the markets being what they are and and what they did – I have another question – the preliminary data that has come regarding the FIIs and DIIs is what is given on the the left – you mean to say that we have gone up 150 odd points on 87.23 Cr of FII and 200.29 Cr of DII buying? Smells like a fish? Yeah the fish may turn out to be the retail – you and me kind who would have just jumped in like there is no tomorrow. GOD bless us all for getting ready for FIIs and DIIs to cull us. Mind you the Global cues are not what they were like yesterday. Infact so much so that there was a bright chance that after the economic data came out yesterday – the US would slip in the red.

Sell like the heavens are falling and buy like there is no tomorrow. And yes the markets went overboard. Now the markets being what they are and and what they did – I have another question – the preliminary data that has come regarding the FIIs and DIIs is what is given on the the left – you mean to say that we have gone up 150 odd points on 87.23 Cr of FII and 200.29 Cr of DII buying? Smells like a fish? Yeah the fish may turn out to be the retail – you and me kind who would have just jumped in like there is no tomorrow. GOD bless us all for getting ready for FIIs and DIIs to cull us. Mind you the Global cues are not what they were like yesterday. Infact so much so that there was a bright chance that after the economic data came out yesterday – the US would slip in the red.

Without wasting any more time let us come on to the global cues. Europe opened flat and after a lot of see – saw closed green with good gains. FTSE was up 0.85%, DAX was up 1.26% and CAC was up by 0.98%. The economic data out of US was mixed to say the least. Goldman Sachs and Johnson and Johnson reported better than expected results. Infact the Goldman Sachs results were impressive – in Bloomberg’s words. Dow was up 0.33%, Nasdaq up 0.36% and S&P up 0.53%. In Asia only Nikkei has opened and is just about 0.31% in green. In another prominent news – China’s reserves have reached a record 2.132 Trillion.

Without wasting any more time let us come on to the global cues. Europe opened flat and after a lot of see – saw closed green with good gains. FTSE was up 0.85%, DAX was up 1.26% and CAC was up by 0.98%. The economic data out of US was mixed to say the least. Goldman Sachs and Johnson and Johnson reported better than expected results. Infact the Goldman Sachs results were impressive – in Bloomberg’s words. Dow was up 0.33%, Nasdaq up 0.36% and S&P up 0.53%. In Asia only Nikkei has opened and is just about 0.31% in green. In another prominent news – China’s reserves have reached a record 2.132 Trillion.

On the candle sticks there was a big white candle yesterday. We seems to be off to the middle of the Bollinger band today if all goes well.

On the candle sticks there was a big white candle yesterday. We seems to be off to the middle of the Bollinger band today if all goes well.

The markets have closed after adjustment above the 50 EMA though the 3 EMA line still trails below it. The volumes were less than the last 25 and 50 day moving average on the NSE.

The markets have closed after adjustment above the 50 EMA though the 3 EMA line still trails below it. The volumes were less than the last 25 and 50 day moving average on the NSE.

ADX still remains bearish and the bulls are likely to give it a go – before the bears are technically more stronger than what they are now. MACD divergence is still negative – but reduced somewhat. RSI is bearish with and attempt to recovery. I had expected the recovery as the Slow Stochastic were oversold and that has happened and they had turned bullish yesterday. The Slow Stochastic has the capacity to take the markets green today too. TRIX is still bearish.

ADX still remains bearish and the bulls are likely to give it a go – before the bears are technically more stronger than what they are now. MACD divergence is still negative – but reduced somewhat. RSI is bearish with and attempt to recovery. I had expected the recovery as the Slow Stochastic were oversold and that has happened and they had turned bullish yesterday. The Slow Stochastic has the capacity to take the markets green today too. TRIX is still bearish.

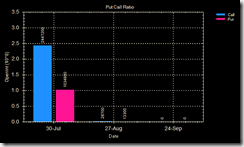

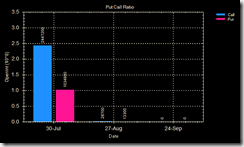

Th e biggest traded volumes on Nifty were – in descending order are Reliance, ABAN, ICICIBank, Suzlon, DLF, AXIS Bank, Unitech. These had the biggest traded volumes on nifty and I am going to present you the Put call ratio for all these – have a look. Yes there is a Put build up but still not the kind that can perhaps help the markets recover – atleast as of now.

e biggest traded volumes on Nifty were – in descending order are Reliance, ABAN, ICICIBank, Suzlon, DLF, AXIS Bank, Unitech. These had the biggest traded volumes on nifty and I am going to present you the Put call ratio for all these – have a look. Yes there is a Put build up but still not the kind that can perhaps help the markets recover – atleast as of now.

Best of luck to everyone for today’s trading and I will introspect as to why I have let the profits on my position drop from 10 k to 3.5k. Should I have had some other stoploss? and if so – what system should I base it on? As of now I am only following 315 Strategy. Ideas are welcome. | Ser No | Stock/Index | Sold / Bought at | Last Closing | Notional Profit/Loss | Stoploss | Remarks |

| 1. | Nifty | - 50 (4185) | 4111 | +3700 | 4207/4202 | Since I expect the markets to go to max of 4200 levels the stoploss can be kept another 25 points above so that it does not get triggered. |

| 2. | Reliance | | | | | Not initiated |

| 3. | Nifty Call | | | | | Looking forward to selling Nifty call, strike 4200 when nifty crosses 4150. |

0 comments:

Post a Comment