We seem to have come made a violent attempt to make a breakout. This has been on the lower side that has been expected by me and my bear fraternity for a long time. So many reasons that the markets were just sweeping below the carpet – and well I think the time has come for the markets to see what the lower side of the life seems like. There has been a Chinese angle to this meltdown and I think that this was about the time that it happened. In any case if this was to happen then either this or that would have been reason enough. No justifications either side. The markets opened gap down and then the sell off just gathered strength without a respite. Look at the FII data – like I had mentioned yesterday that the FIIs do not seem in any mood to buy into our markets any longer. Now there is another thing that we are perhaps are not considering – and that is that though the DIIs are merrily pumping in money at each level – where do they have their stop losses? (If any – I am certain that since they are playing with my and your money – the stop losses are far away)

We seem to have come made a violent attempt to make a breakout. This has been on the lower side that has been expected by me and my bear fraternity for a long time. So many reasons that the markets were just sweeping below the carpet – and well I think the time has come for the markets to see what the lower side of the life seems like. There has been a Chinese angle to this meltdown and I think that this was about the time that it happened. In any case if this was to happen then either this or that would have been reason enough. No justifications either side. The markets opened gap down and then the sell off just gathered strength without a respite. Look at the FII data – like I had mentioned yesterday that the FIIs do not seem in any mood to buy into our markets any longer. Now there is another thing that we are perhaps are not considering – and that is that though the DIIs are merrily pumping in money at each level – where do they have their stop losses? (If any – I am certain that since they are playing with my and your money – the stop losses are far away) And that they will start selling at much lower levels. I pray for my mutual funds. For all those who think that the market has already dropped so much and would not like to jump on the shorts – then think again – the fall has just started and it is of global scale – if what I see purely on the charts alone then there is along way to go and that way is just pointing downwards. The markets should give a confirmation that he trend is down and down only. Okay – now I will try not to get carried away and come to the Brass tracks…

And that they will start selling at much lower levels. I pray for my mutual funds. For all those who think that the market has already dropped so much and would not like to jump on the shorts – then think again – the fall has just started and it is of global scale – if what I see purely on the charts alone then there is along way to go and that way is just pointing downwards. The markets should give a confirmation that he trend is down and down only. Okay – now I will try not to get carried away and come to the Brass tracks…

The Global cues are bearish and actually saying bearish without throwing a bucket of red paint on top of it would perhaps convey the situation a bit better. After burning every index and stock in Asia the fire went on to Europe with FTSE down 1.48%, Dax down 2.02% and CAC down 2.16%. US opened well in red and then traded in fairly narrow band to close at the lowest for the day. Dow was down 2%, Nasdaq down 2.75% and S&P down 2.43%. The Asia once again started the day in red but Nikkei is now green up 0.2% – the strait Times – now in early trades is just 0.16% down. The meltdown yesterday was supposedly due to profit taking in the wake of slower-than-expected economic growth in Japan. It has been described as one of the worst single day percentage loss in last six odd weeks.

The Global cues are bearish and actually saying bearish without throwing a bucket of red paint on top of it would perhaps convey the situation a bit better. After burning every index and stock in Asia the fire went on to Europe with FTSE down 1.48%, Dax down 2.02% and CAC down 2.16%. US opened well in red and then traded in fairly narrow band to close at the lowest for the day. Dow was down 2%, Nasdaq down 2.75% and S&P down 2.43%. The Asia once again started the day in red but Nikkei is now green up 0.2% – the strait Times – now in early trades is just 0.16% down. The meltdown yesterday was supposedly due to profit taking in the wake of slower-than-expected economic growth in Japan. It has been described as one of the worst single day percentage loss in last six odd weeks.

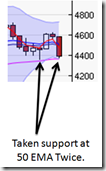

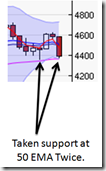

Next I come to the Candle sticks. Frankly what I had expected yesterday was a piercing candle – that would go more than two third down the white candle we had on last Friday and that would ideally had been enough to signal a good reversal – but the markets just did not stop there and continued the journey till they took support at the 50 EMA. I have magnified and put the candles up for all to see. The candle had taken a support on 12 Aug and now 17 Aug. 3 EMA has definitely fallen below the 15 EMA and 15 EMA is just 14 points above the 20 EMA – actually poised for a fall below. Already the 315 has generated a sell – second time in last ten days. – now it has to be seen whether we bounce back vigoursly to show that we are range bound or continue down. The ADX gave a sell yesterday and today too the value is 14 – so it will only be in these coming few days that we will know whether this downtrend has enough strength to sustain. MACD remains bearish. RSI generated sell and TRIX is looking down. Slow Stochastic too has turned around but not really given a sell. All in all – majority are either generating sell or justifying a greater downfall of indexes.

Next I come to the Candle sticks. Frankly what I had expected yesterday was a piercing candle – that would go more than two third down the white candle we had on last Friday and that would ideally had been enough to signal a good reversal – but the markets just did not stop there and continued the journey till they took support at the 50 EMA. I have magnified and put the candles up for all to see. The candle had taken a support on 12 Aug and now 17 Aug. 3 EMA has definitely fallen below the 15 EMA and 15 EMA is just 14 points above the 20 EMA – actually poised for a fall below. Already the 315 has generated a sell – second time in last ten days. – now it has to be seen whether we bounce back vigoursly to show that we are range bound or continue down. The ADX gave a sell yesterday and today too the value is 14 – so it will only be in these coming few days that we will know whether this downtrend has enough strength to sustain. MACD remains bearish. RSI generated sell and TRIX is looking down. Slow Stochastic too has turned around but not really given a sell. All in all – majority are either generating sell or justifying a greater downfall of indexes.

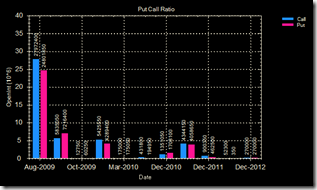

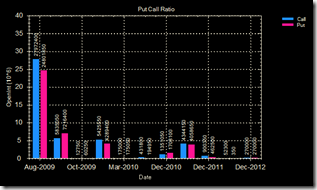

As far as the option data is concerned the Put call ratio has reached 0.8866 and open interest is maximum in 4700 call and 4300 put. So on the down side the 4300 may be a difficult nut to crack. Besides this there is a build up in 4600 and 4500 call so upward journey may be as painful with 4700 being the absolute max. The option pain is minimum at 4500 – 4400 range at the moment. Inspite of reliance defying the general bearishness of the markets I was certain that it will never cross 2100 because of the highest call buildup there and now I am even more certain as basically there is only call buildup with very less put writing – so the downside in reliance may be expected more than the yesterday’s 94 Rs odd fall.

To summarise global cues remain to be bearish. On charts all seems favouring the bears though a small bounce cannot be ruled out due to the ferocity of the fall yesterday. The options are still not showing the extreme of sentiments but still favours the bears. Ideal strategy is to remain short – do not hold shorts if likely to close above 4604, If holding log best would be get off the bus at the best levels today – and do not hold longs in any case if closing below 4464. For intraday go short below 4486 and long above it.

| Indicator | Bullish/Bearish | Sell/Buy Signal | Nifty at signal | Points gained/lost since (4387) | Remarks |

| 315 Strategy | Bearish | Sell/17 Aug | 4387 | - | |

| ADX | Bearish | Sell/17 Aug | 4387 | - | |

| MACD | Bearish | Sell/06 Aug | 4586 | + 199 | |

| RSI | Bearish | Sell/07 Aug | 4387 | - | |

| Slow Stochastic | -- | -- | -- | -- | No signal |

| Options | Neutral / bearish | -- | -- | -- | |

2 comments:

paaji,

good mrng,

looks like u again will be on the wrong side of the track today :)

paaji good write up today,mood ban gaya mera... :D

Post a Comment