You want me to place my bets in this upmove? See the FII/DII data – the purchasing by the FIIs does not at the moment show too much of enthusiasm. The markets are perhaps being forced to be kept range bound – and that may remains so till the expiry. On Friday the markets moved up with a sudden drop in open interest in 4500 Calls. Now the range may be dictated by a different level in Nifty but all the same the range is likely to remain till such manipulations disappear. The second factor working in favour of the markets at the moment (negate the China factor) is the fact the globally there is a talk of being high and dry out of recession. The results coming out an the various forecasts may be pointing towards that. Finally all the world markets are waiting for me to become bullish – it is only then the bears will get a signal to strike. It will be when you me and the tom around the corner is convinced that we are out of the woods and when we reach the other bank – we will stare with complete disbelief and the markets will fall. That they are not falling means that everyone is still not board the bull bus.

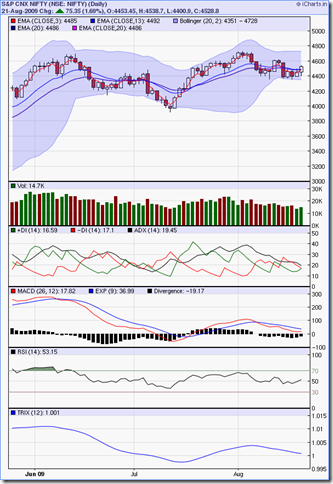

As far as the charts are concerned – they display the typical confusion associated with range bound markets unable to breakout in any direction clearly. We have had two white candles and we have moved from the bottom of the fairly constricted Bollinger Band to the middle. Now either we come down – to once again test the bottom of the Bollinger band or move on to pierce the middle to go on to the upper edge. The 3 EMA line is just about 7 points below the 15 EMA line and if we have a good day then a buy signal may be generated today on 315. If we have a break up then those pacing their bets on inverted head and shoulders may be the ones cheering. Volumes are low – just 78% of the last 50 day average. Even in this upmove the ADX has not even budged an inch. RSI and Slow Stochastic have generated a buy signal and MACD is still in favour of the bears. TRIX is still looking down. So all in all you can take any stance but like bears earlier – I would be vary of the bulls too. (The ADX as shown in the iCharts is incorrect)

The Put call ratio has moved in favour of the puts. The highest Open interest in the order of high to low is 4300 Put, 4400 Put, 4600 Call, 4700 Call, 4500 Put and 4200 Put. If you observe carefully you will realise that 4500 Call has conveniently disappeared from the scene. So next level to watch out is 4600 and if we do go there then we should ideally have a Put build up at 4500 that would define the range of 4500 to 4600 till expiry.

So all in all to summarise – Global cues are rocking for bulls. Indicators on the charts started favouring bulls – Option data defined a new range – above the earlier range as the favoured range for expiry. So all in all we can test the upper Bollinger Bands. Best of luck to everyone for the today.

2 comments:

the best analysis with clearcut concluding comments.it is for your kind consideration if economic data dollar level commodity oil levels etc are also corelated to show relative strength of equity markets.kindly also advise on stocks worth buying at these levels.

Hi Sukhminder,

Thanks for the comment. The problem at my end is purely managing time alongwith the job I have. Will try my best to incorporate - but it may take time.

Thanks all the same once again.

Cheema

Post a Comment