I am sorry - but lately I have been busy and have got orders to move to a new station. I will have to say good bye to blogging in the near foreseeable future, so - though I am still not closing the blog but will not be able to update it.

It has been a great experience blogging here and I will add it in the end here - that in all the probability I have learned more blogging here than anything else.

Thanks for being such good friend, critics and supporters.

Cheers

Sunday, September 20, 2009

Moving...

Monday, September 14, 2009

Update for 15 Sep 09…

The options data is roaming around at the same place so I will not spend time to dwell upon it too much. The PCR is 1.81 and that is the expectations of the majority speaking that the market will fall – or let us put it this way that the markets should fall. The writers of Puts will not like that situation obviously so we can still wait out for a major fall to come our way.

All in all the trend so far remains bullish and for those long do not hold longs if the markets are likely to close below 4795 those in the bear camp who are short should not hold shorts if the markets are likely to close above 4859. For the day be long above 4807 and short below this level.

May you all make money. Good luck!

Sunday, September 13, 2009

Update for 14 Sep 09…

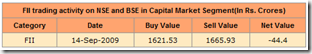

This is the time when the confusion galore in everyone’s minds. There is just no clarity as to where and when the markets will move. On top of it all the technicals are not helpful, Fundamentals are on shaky ground and result is – what the heck and were the heck are we off to? More high in sight? maybe! How about lows? Maybe! The FIIs buy – DIIs sell – DIIs buy FIIs sell. I think that this will continue and the sell off if it comes will be big. So many rumours floating around. So much of data pointing nowhere and still we have to go along with our days and night dutifully.

This is the time when the confusion galore in everyone’s minds. There is just no clarity as to where and when the markets will move. On top of it all the technicals are not helpful, Fundamentals are on shaky ground and result is – what the heck and were the heck are we off to? More high in sight? maybe! How about lows? Maybe! The FIIs buy – DIIs sell – DIIs buy FIIs sell. I think that this will continue and the sell off if it comes will be big. So many rumours floating around. So much of data pointing nowhere and still we have to go along with our days and night dutifully. Let me first begin with the Global cues – though they are touching new highs – they seem to be in doldrums like everyone else – taking each step forward with caution but moving ahead all the same. Take Asia for example – Nikkei was down 0.66%, Hang Seng up 0.44% and Strait Times down 0.04%. Europe had some bit of more clarity and they spent time comfortably in green. FTSE was up 0.48%, DAX up 0.52% and CAC up 0.78%. US was red but definitely off their lows – and almost recovering the losses of the day with DOW down 0.23%, Nasdaq down 0.15% and S&P down 0.14%. It is more like that they are standing still in a time wrap for some event to come – some trigger to push them somewhere.

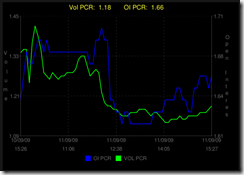

To sum it up I would put it across this way for the Monday markets – Global cues may remain tepid – may be because of consolidation or a correction. Technicals are bullish but getting overbought and Doji is yet to work out –so be careful. The options data says that we are not likely to fall easily but keep an eye on the PCR and the volumes – increase or drop – whatever. The picture of the PCR above is liked to the sire where you can track the PCR real time.

Ideal strategy is to remain long with a stoploss on closing below 4794, those short can keep a stoploss at closing above 4857. For the day remain long above 4806 and short below it. May you all make tons of money.

Friday, September 11, 2009

Update for 11 Sep 09…

On the charts – as I see it there was a Gravestone Doji and that may show some selling pressure for a few days ahead of us. Since the FIIs have been net buyers the selling would have then come from the unconvinced DIIs and retail. The volumes have been 104% of last 50 day average so on that account cannot say that we have been overpowered. Second thing that I notice is that we have not been able to violate the upper Bollinger band – we should have been trailing by violating the upper Bollinger band if this upswing was to continue with steam. There is smart support around the 4 EMA levels and 4 EMA is at 4690 exact – so watch out for this level. If we do go below this level then the lower logical level should be middle of Bollinger bands around 4650 and the real bad downturn can come only below this level. One can never really say that this will come or not as there are reasons for strong supports along the way that I will cover as I complete this writeup. Needless so say that buy was generated on the 315 on Sep 4th. The trend line support is at 4660 levels. So that doubles the effectiveness of support available at around this level. ADX has finally started rising and is up to 16 as of today and I will still wait for the crossover of 20 to see the trend and crossover of 40 for the trend to strengthen up. MACD is bullish though mildly. RSI is bullish at 64 points and trailing above the SMA (15) at 59. If RSI is to fall below around the level of 58/59 - it could indicate weakness otherwise the party will continue. Another problem is the Slow Stochastic that are overbought and has had a bearish crossover of %K line below %D line. The TRIX too signals a rally up so far.

Now coming to a very interesting part – Options data.

I will summarise – as far as the global cues are concerned the US is doing great but it has failed to inspire the rest of the world in real terms. The downward infection now may travel from the rest of the world to US and we may see US sobering down at these or a little higher levels. The global cues for us remain mixed with a bit of weakness. The technicals are bullish but becoming stretched. Options should keep the markets range bound giving stiff resistance for the markets to break down meaningfully. So consolidation in this band might happen and levels will be broken on the upside or lower side next month. Ideal strategy might be to dilute longs at higher levels (talking of nifty positions) and buy on dips. For those holding longs do not hold if likely to close below 4791, for those who took shorts do not hold shorts if likely to close above 4852. For the day buy if above 4790 and sell below this level.

Best of luck and may all of you make money and tons of it.

Monday, September 7, 2009

Update for 07 Sep 09…

On the charts the markets bounced once again from the middle of the Bollinger bands not really bothering to violate the middle of the bands to test the lower band. It also coincided with the support as you would be seeing on the chart on the left. Now to this end we are very close to test the upper Bollinger Band at 4779. The range too has become so constrictive that a breakout is just a matter of time and I would still not bet on the direction of the breakout. Notice two things on the charts – the green ticks do not have relatively more volumes than the red candles. The red candles are with a little bit more volumes than green candles. Now that is the reason I say that it is difficult to say who is running out of steam. Not only that it may be prudent to point out the FII and DII data once again.The TRIX is flat with perhaps a little positive bias.

As far as the options data is concerned the PCR is at 1.23 – resisting the markets from going into a free fall. Options pain says that 4600 is the level and till that moves the markets are signalling a hovering around this point. The greatest open interest is at 4600 Put now with 45.93 lac, 4500 put with 44.41 lac open interest, 4800 call with open interest at 36.19 lac (next bus stop around 4800 levels?) 4300 put at 33.78 lac and 4000 put with 33.14 lac open interest. So that does give us some sense as to where we are heading for.

I will summarise this in the following manner, Global cues are good. Our Charts are mixed with volumes and the ADX not playing up still. The Options data point out towards to some more upswing before we stop. All in all the ideal strategy would be to remain long. The stoploss for longs would be closing below the 4579 level and if holding shorts then keep stoploss of close above 4665 for the day. For today go long above 4644 and short below it. I wish all of you luck for today’s trading.

Friday, September 4, 2009

Update for 04 Sep 09…

The Global cues are mixed – doing the tango as I say usually. Asia had Nikkei down 0.64%, Hang Seng up 1.23% and Strait Times up 1.11%. Europe ended in red inspite of keeping flat for the majority of the session. FTSE ended down 0.43%, Dax was down 0.35% and CAC ended 0.55% in red. Europe fell on US concerns and US that has had four days of slide found some hope and pushed its way up. The US markets – past the mid session now are crawling to a little higher levels. Dow at the moment is at 0.32% in green, Nasdaq 0.47% in green and S&P 0.42% in green. The US markets too are fighting for foothold around very important support and resistance level. Nasdaq at 2000, S&P at 1000 levels. The chances are bright that the US markets will end up green – max about a percent or so.