Okay – let me start this like this – before I start with the article proper let me tell you a story that I came across on the internet by a Steve Austin about the oil prices. I am telling you this as I believe that at a point of time sooner rather than later we will get affected by the oil price and at the moment it does not seem to be a pleasant site.

I have pasted the article from a website and you can reach the site by Clicking Me. I am leaving this link for two reasons – firstly all the articles on the site are eye openers and secondly the credit is his (Steve Austin) and his alone. I quote

“It took only 5 months for the price of oil to plummet from $150 to under $40 in the second part of the year. Meanwhile oil consumption did not even decrease 10%, so what is the real cause of this collapse you may ask?

Hedge funds. Let me explain.

During the first part of 2008, Western economies were already slowing down noticeably and hedge funds gradually pulled trillions of dollars out of the market and parked them in energy ETFs. At the time Chindia's insatiable thirst for oil and the "decoupling" of east/west economies had many believe commodities were a "sure thing", a sound enough tangible insurance to protect overinflated assets scavenged from made-up bubbles. On top of that, by using leverage, profits were multiplied as oil went up, not a bad deal in a recession.

But when the banking industry collapsed, hedge funds had to raise cash by "deleveraging", liquidating their leveraged energy ETF positions sending the price of oil tumbling. Anecdotally shorting of banking ETFs was suspended by the US Securities Commission during that time but not shorting of energy prices, and the leverage mania soon found an escape route in utrashort oil ETFs, compounding the speed of this downward spiral. By December 2008 the oil price had collapsed 75% and frankly, who would complain about cheap gas these days?

As we enter 2009 the oil landscape has reversed dramatically from a year ago. The price of oil is lower than production costs and new exploration projects are being cancelled. China flush with cash is currently buying all the oil it can get its hands on to pump into its strategic reserves. Once arrogant OPEC countries are willing to sell oil at any price to fund government programs and prevent political instability.

One constant however is the depletion of major oil fields, worse than predicted at 9.1% year over year as we close 2008. It's a matter of when not if the economy recovers and when it does, expect a strong bounce back in the price of oil.”

After we see it in the context of the fact that there were some sort of news floating that Govt wants to deregulate the oil pricing and leave it in the markets forces hands till the price of the oil internationally is below 75 Dollars a barrel seems to be in doldrums as the price has already reached the 72 $ + mark in last few days. The govt is likely to have two options – keep the deregulation of oil prices on back foot – and perhaps loose some credibility of an area of thrust and secondly deregulate the prices and upset the inflation – the govt has been careful to ensure does not go out of its hands. classical case of ravine on one side and well on the other. It will be interesting to see how the govt moves about handling this.

Apart from this the Reliance-RNRL case coming up on Monday, decision of some companies not to buy gas from Reliance and the upcoming budget will play a major role in the days to come.

As far as the global cues are concerned – Asia was okay – not considering our markets which are onto 13 weeks of winning streak. Nikkei was 1.55% green – the best performing, Hang Seng was green too at 0.52% up and Strait Times was red at 0.20% down. Europe started the day flat – tried to go green but that became the highest for the day – ending down in red – FTSE down 0.45%, Dax down 0.74% and CAC down 0.26%. The US markets closed mixed with the DOW up 0.32%, Nasdaq down 0.19% and S&P up 0.14%. All in all the markets the world over seems to have run out of the steam they were in till last week.

On the candle sticks there was the second red candle and the 4690 level is presenting a good resistance to the markets that I have a feeling will remain in place for some time to come – till the time the markets corrects and resume its upward journey again. The Bollinger Bands have constricted and are narrowing down quite fast. 3 EMA remains above 15 EMA. Volumes were no great shakes. Though the ADX is still bullish – the +DI line looks down and so does the ADX line (Black) that is not a good sign as the ADX had bounced back from just above 20 level and now seems to be turning back before showing the strength by crossing 40 level. The –DI on the other hand seems to start moving up again. MACD is bearish with increasing negative divergence. RSI has just left the overbought position behind and is looking bearish. Slow stochastic may be the only bullish signal at the moment but once again likely to enter the overbought position soon. The TRIX has also started looking down. For all those who have faith in technicals – it is time to sit on cash once again and wait for opportune time to strike.

Coming on to the pivot data now…

R3 4840

R2 4741

R1 4662

Pivot 4614

S1 4535

S2 4487

S3 4408

Projected High Range 4638 to 4701

Projected Low Range 4684 to 4621

Fib Projected High 4727

Fib Projected Low 4531

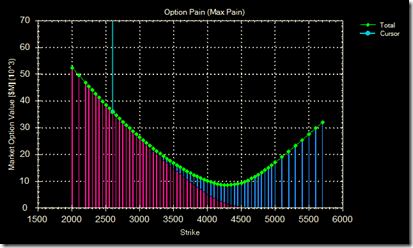

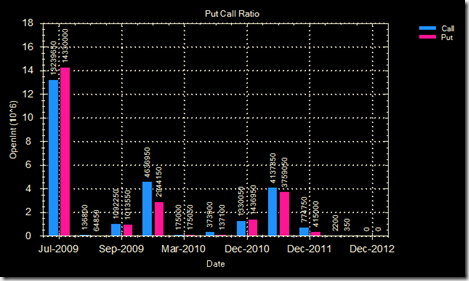

I will not post the usual option pain and Put call ratio for Nifty but will do so for Reliance. All those who are experts looking out this type of data – though the reliance was one of the only stalwart in last trading session – the question is – Is reliance in big time trouble?

I will end my write up here and will wish you all luck for the coming few days. If you do sit on some cash then wait for some 10-15% correction before coming back in.

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjMsahr0OGsdLjR3BOU1ls_-QRmjhyphenhyphenmr5ioXwQgzpEfCvb_hasHPf3Xs4sWRkNYjaCN5JyvGo_QxbYtN9yYy6DWhWuJq4_7HU6zqrToIL6FdCWWEmIOkT2vitl42NNQn4_mF5SidjAgcpex/?imgmax=800)