Frankly I lost heavily in Jan 08. It was one of those times when the circumstances perhaps conspired against me and million of other retail investors and we held on to our hopes (read futures) – at every stage daring them to go further down, at every downturn we hoped that the markets will recover. That was the time when I did not study stocks and futures and was there because there was perhaps – everyone else doing it. What a crash it was – it was a Tasmania that took along with it millions of dreams. Where did we go wrong? We went wrong in trying to fight the tidal wave that was of a far superior creation than what our thoughts will be. And we were not hedged. Thinking back today I want to roll back the clock that never will and here I am with the most costly lesson of my entire life. Hedging Futures.

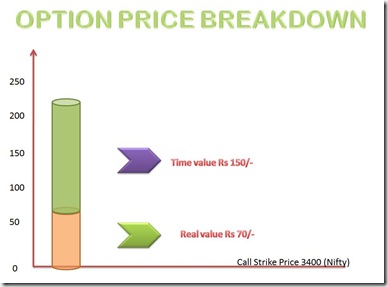

Before I start I let us understand some things. If I buy a option then there the option is priced on some formula and we in India follow the pricing based on Black-Scholes model. You can do a google for that term but beyond this I do not need to explain this term. There after coming to the price of the option - it has some points that I intend explaining. Let me take for example today the Nifty closed at 3470. The 3400 call option costs me Rs 220/-. Let us now break it down. Ideally the 3400 option today should have been Rs 70/-, but it is not so as there is a premium demanded on the option. The premium demanded is = 3470 – 3400 = 70. 220 – 70 = 150. Since the Nifty is traded in lots of 50 – the money that is demanded for the premium is Rs 150 X 50 = 7500/-. Remember that this is the money I am betting to loose for taking or let us say hedging a position. WOW –

Now I am paying in this case Rs 150/- as a premium because there are 30+ days to expiry. As the expiry comes closer – the premium will decay. The decay goes something like this. So If we have the market ending the month at exactly the same place as it is today then no one can take the real value from you – and the premium will decay to near worthless. If you have understood this then we will now workout our strategy wherein we risk the premium only for hedging.

Now have your mind clear whether we are likely to trend up or trend down. This strategy works best in trending markets. Let us say I am bearish about the markets (like I am now a days) I would like to sell a nifty future. So I sell May Nifty future

Let us now see what happens in all the three scenarios – Markets falling (as I expected), Markets remaining range bound (Aka ending at the same point) and markets rising (What I did not expect).

- First Scenario: Markets falls – Let us assume the market falls by 100 points Nifty.

- Market at 3370.

- Future falls 100 points – I get 100 X 50 = Rs 5,000/- credit in my account.

- The option priced at Rs 110/- - option looses Rs 5,500/-

- Market falls another 100 points

- Market at 3270

- Future falls 100 points – I get 100 X 50 = 5,000/- (Plus 5,000/-) a total of 10,000/- in my account.

- Option priced now at Rs 40/- - option looses 180 points = 180 X 50 = 9,000/- ( Real gain starts now) gain = 10,000/-(gained over two days) + 40 X 50 (Option is still worth 40 Points) = 2,000/- minus 9,000/- a total gain of Rs 3,000/-

-

- Beyond this point I will gain almost a 50 Rupees for every point of drop in Nifty. So max gains – take an example of the month of April where the markets moved 900 points – gains will be 900 X 50 = 45,000 minus 11,000/- (Price of the option) = 34,000/-. So gains are unlimited.

-

- Second Scenario: Month expires at 3470 -

- As the time passes by and we come closer to the end of the month – the decay of the option premium will set in and real value cannot go anywhere whereas the decay will eat the 150 point premium we had given that is a max loss of Rs 7,500/-

-

- Third Scenario: Markets Rise – Let us assume 100 points.

- Market at 3570.

- Future rises by 100 points – my account debited by 100 X 50 = Rs 5,000/-

- Option priced 310 (rises by 90 points) so I am plus 4,500/- in options

- Total loss Rs 500/-

- Market Rise another 400 points

- Markets at 3970

- Future rises by 400 points – my account debited by 400 X 400 = Rs 20,000/-

- Option priced 650 (rises by 340 points) so I am plus by Rs 17,000/-

-

- In all the max I will loose is the premium I paid for the Call that is Rs 7,500/-

-

Actually a lot of people would be sh*t scared seeing the 7,500/- figure I am showing as a loss. Remember that it is the maximum in the worst possible case wherein either the market has run away 900 points against you or you wait with the markets not moving anywhere for 30 odd days. Remember that there are ways and means to still keep the losses in a check. So before I come to the solutions and discuss the solutions I will like to present some more problems that you should keep in mind. Problems and how to over come them. Please remember that these are suggestions and there you can be more creative than possibly I can ever be.

First is that we have seen that the premium of the options is more if the time to expiry is more. The premium is not a sine or a cosine curve like it is represented on the chart. However there are some thing you can definitely keep in mind.

- The premium is very high when you take the next month or the following months options so I advice stick to the near month for options.

- The premium gets lowered the deeper IN MONEY the option is. For the above example had I bought 3300 call – on the face of it it would have seemed expensive but if I take out the pure premium – the premium would have been less and so for 3200 strike will be even lesser and so on. Real example the 3300 call is at 280 so premium is 3470 minus 3300 = 170. 280 minus 170 = 110. So just 110 points premium against 150 point premium of 3400 call.

- The out of money option is pure premium and that is a sure loss. The loss will build up till the option comes in money and tries to beat the loss for point per point.

- An example market at 3370 – I sell future. I buy a call of 3600 strike for 110 points. Market go against me – rises by 100 points – I loose 5,000/- and call rises by 35 odd points – yes it is around 30% of move but as the option is not is money – It will not move close to point for point loss I will make in Futures.

-

- The deep in money and out of money options tend to become illiquid. Except for Nifty and a handful of stocks – this statement is true so you will have to take the route to exercise the option if you are deep in money for such stock options hedges.

- The premium drops to low in the last few days (10 odd) to expiry and for a very small premium you can take good positions. The premium in last 10 days to nifty dropped to 40 points. – That is a risk of 2,000/- for hedging a position.

- As far as the futures are concerned the money comes in or goes out everyday so have adequate margin available if the markets are to go against you. For options the money is paid initially only.

Now for some clarification. Even if the markets go against you or your taken position – how many days will you take to realise your mistake? One/Two or Three days? well there would be negligible money lost to the decay factor of the option if you do decide to call quits soon enough. If you do come in this situation. Come out of the market and decide another entry point. Finally I will suggest you one thing – when you do come out - come out of both the positions. If you close one position and leave the other open then the game is as good or bad as playing unhedged. Mind you – in unpredictable times you will never come out of the markets with a headache if you follow this principle and that is what I can promise. Secondly there is nothing really in the markets that will give you returns like a Future will do in the markets.