A new week – a new battle to be fought and won… Uh!! To be lost perhaps. It has been a mixed week – with good news (SBI results and TISCO) at the domestic front being set aside – or let us say not being fully factored considering the US economy assessment of the Feds and IIP on the home front and the spiking inflation. Nifty inched up a bare 0.2% – and the BSE virtually remained flat for the week.

Now leave this aside for the moment and ask me where I see the markets in the coming few days? – Down I would say or in the best case scenario – confused. The IT, Pharma and Metal indices were the major losers and the Reality,Banking and Auto the winner of the week gone by.

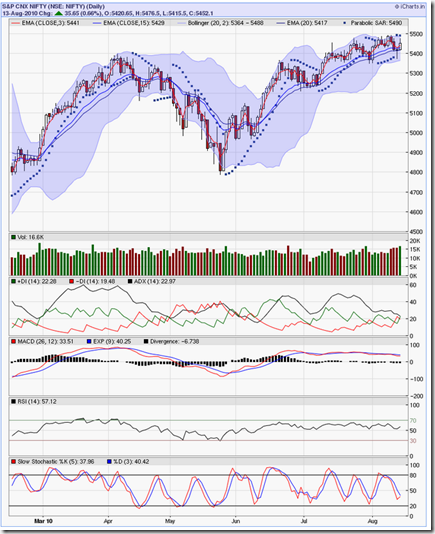

The markets are still trailing the bands that I drew out a couple of days back and till the time they are decisively broken – the range bound markets can continue to play out – up one day and down the other. Okay so where do we stand now? Bullish on a few counts and bearish on the other counts. Take the candle for example – the white candle has pierced the previous black candle on closing basis (two thirds into its body) so seems that the bulls are catching up and do not want to give in so easily. But on the other hand it could violate the upper Bollinger band nor could it touch the trailing down PSAR – so it is bearish on these counts. Two additional bullish indications are – the candle low bounced off the middle Bollinger band and the 3 (EMA) bounced off 15 (EMA). Well the volumes were 117% of last 50 Day average. So far so good. Now if I was to draw trend lines – the I would show the upper and the lower one. The upper one stops the advance of our markets around 5525 (Nifty) and low around a shade more than 4925. Coming to the other indicator that I use. The ADX is showing a non trending momentum so do not expect it to go anywhere fast. Infact there is a divergence made by the Nifty and this indicator. I told you last time – Didn't I?MACD is bearish and RSI is in a trend up. MACD is in a downtrend – but decided to turn before going overbought – With all this read the market as you would like to – the fact remains that we are in the middle like suckers – waiting again for a direction to emerge.

The markets are still trailing the bands that I drew out a couple of days back and till the time they are decisively broken – the range bound markets can continue to play out – up one day and down the other. Okay so where do we stand now? Bullish on a few counts and bearish on the other counts. Take the candle for example – the white candle has pierced the previous black candle on closing basis (two thirds into its body) so seems that the bulls are catching up and do not want to give in so easily. But on the other hand it could violate the upper Bollinger band nor could it touch the trailing down PSAR – so it is bearish on these counts. Two additional bullish indications are – the candle low bounced off the middle Bollinger band and the 3 (EMA) bounced off 15 (EMA). Well the volumes were 117% of last 50 Day average. So far so good. Now if I was to draw trend lines – the I would show the upper and the lower one. The upper one stops the advance of our markets around 5525 (Nifty) and low around a shade more than 4925. Coming to the other indicator that I use. The ADX is showing a non trending momentum so do not expect it to go anywhere fast. Infact there is a divergence made by the Nifty and this indicator. I told you last time – Didn't I?MACD is bearish and RSI is in a trend up. MACD is in a downtrend – but decided to turn before going overbought – With all this read the market as you would like to – the fact remains that we are in the middle like suckers – waiting again for a direction to emerge.

Well the options data – before I pen off. 5600 calls added 5.1 lacs in open interest to reach above the magical figure of 105.94 lacs, 5500 call added 3.42 lacs to reach open interest of 80 lacs. As far as the Puts are concerned – 5300 puts stand at 124.79 lacs and 5400 puts stand at 95 lacs – infact the 5500 puts aslo added 11.39 lacs in open interest to reach 45 lacs. So the juice in this – options dictate the broad range of 5600 to 5300 and a tight range of 5400 to 5600 this expiry.

What would I do? well I would short the market around 5500-25 and then give another 25 odd points for the market to play out – wait for a correction and sit tight on the short. What else can you do – well sell 5600 Calls as we cross 5500 and sit tight..

I would also take the opportunity to welcome all those who have come back to the blog. Veer you had asked me the question about Vega – please give me a day will give you as you would like it to be on your table.