I was going through a write up on technical analysis by Steven B. Achelis and was surprised that during the beginning of the use of technicals – they were compared with the Voodoism!

Looking back with the kinds of comments that I get sometimes I wonder whether we are living at any other different times. One must understand that it is impossible to predict the future. Take for example the Black Swan principle, it makes it impossible for anyone to predict the future as it proposes that the surprises topsy turvy your expectations. If that be so then leave aside technicals -- no fundamentals can either point towards the future. But then there has to be something that -- even if it does not predict the future price trend - still gives us a sense of what may happen as an iota of an probability more than expected.

Everyone knows that the technical analysis is all about looking at the past and trying to predict what will happen in the future under the same circumstances. The problem is that the circumstances are never the same. So all we get round it and get an anchor on which we can rely. There are millions of complex mathematical probabilities that are used to predict an outcome, unfortunately none of them have stood the test of time. Otherwise this world as we know it will not be there. In my opinion the technical analysis is not perfect but then neither is anything else. So in all my wiseness have chosen technical analysis over the fundamental analysis. Atleast in technical analysis there is an advantage of looking back and feeling happy that under those circumstances had I entered the trade I would have been millionaire. And being an optimist is that I am I know that -- that miracle trade is just around the corner.

Now talking about the fall we had yesterday – there are no absolute answers so I will just try to list out the circumstances under which we may have fallen in the last half an hours or so.

Now talking about the fall we had yesterday – there are no absolute answers so I will just try to list out the circumstances under which we may have fallen in the last half an hours or so.

-

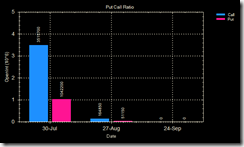

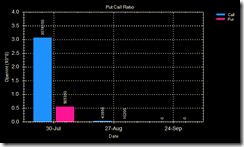

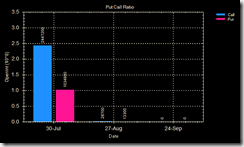

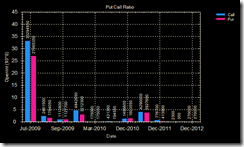

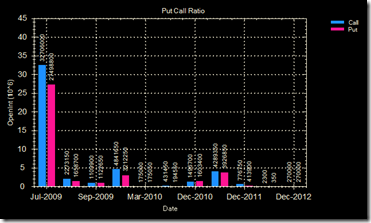

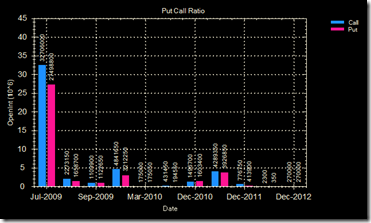

One of the strongest argument that I can find for this sell off was – excessive optimism. Evidence was there that I had started posting on the blog – see there was no put build up to start with – only calls and calls and calls. Can you imagine? only call build up. I saw that happening a few months back – only put build up – I did not know what to make out of it – but this time around I think I read them correctly.

-

The second was the budget. Good budget notwithstanding – the aura for markets was negative. How and why – you will have to refer to some one else

-

Third was this faint little rumour that the monsoons will not be average.

-

Finally was that the global cues are just not playing up. Now I have written time and again – we have a recession – we might come out of it – yes – but to go back to the growth rate previous to this recession – will take a long long time.

-

And to all those – the fundamental variety type – technicals said so. ;-)

-

There may be something that we do not know yet.

Let me tell you what I have written above has no meaning for me – because it is like justifying what has happened and nothing else and after a long time I have realised there is no reason at all that justifies what the markets do – so just take the signals and be on the right side of the trend – and technicals help.

As far as the global cues are concerned – they are not particularly good – not particularly bad either. But that thing that we have been riding on previously – India outshining the world is making us go down and cover the lost ground. Nikkei was 0.04%, Hang Seng closed 0.46% down and strait Times 0.02% green. Europe was down – FTSE 0.76% down, dax 1.16% down and CAC 1.42% down. US was a mixed bag – Dow down 0.45%, Nasdaq up 0.2% and S&P down 0.4%.

On the charts we are trailing bottom edge of the Bollinger bands and once there – there is no knowing till when we will trail this. We have the 100 EMA and 200 EMA at 3827 and 3724 respectively – breaking of each of these supports will weaken the markets further. I am looking forward to some support at these levels. ADX is now building up the strength of this downturn. MACD is bearish like hell and RSI too is bearish but not oversold yet – so wait for some more time before there is some consolidation before going down deeper perhaps. Slow Stochastic is bearish but over sold. TRIX is still looking down.

On the charts we are trailing bottom edge of the Bollinger bands and once there – there is no knowing till when we will trail this. We have the 100 EMA and 200 EMA at 3827 and 3724 respectively – breaking of each of these supports will weaken the markets further. I am looking forward to some support at these levels. ADX is now building up the strength of this downturn. MACD is bearish like hell and RSI too is bearish but not oversold yet – so wait for some more time before there is some consolidation before going down deeper perhaps. Slow Stochastic is bearish but over sold. TRIX is still looking down.

As far option data is concerned – see the problem – the more viciously we fall – the more hope there is of recover and more the call will be written and the more painful will be the process of the recovery. That is the way of life and the markets.

As far option data is concerned – see the problem – the more viciously we fall – the more hope there is of recover and more the call will be written and the more painful will be the process of the recovery. That is the way of life and the markets.

I will now put forward the positions that we were carrying forward. Can you believe it – what to talk about others I too was just not ready to take the reliance position though the markets are looking weak. All the same even the lone nifty is not doing badly. I do not know why the markets sold off yesterday – but I am sure that there will be more selling in the coming few days.

| Ser No | Stock / Index | Sold / Bought at | Last closing | Notional profit / loss | Stoploss | Remarks |

| 1. | Nifty | - 50 (4185) | 3994 | + 9550/- | 4238/4233 | Stop loss is at 15 EMA level and once the RSI is oversold we will shift it closer so that we can take advantage of the bounce short covering that is likely to happen at 3800/3850 level. Do not sell off – and take out profits prematurely. |

| 2. | Reliance | | | | | Not Initiated. |