- To the bears: The markets have the capability to open gap up everyday and climb up without so much so a 20 point correction – till the shorts squeeze you dry. I wonderful quote that I had read a long time back went on something like this… “The markets can remain against you longer that you can remain solvent…” Makes sense now.

- To the unsure bulls: let us assume the markets have run up 500 points without a stop and you want to enter the markets when the markets correct. You wait – the markets run up another 300 points – correct 100 points – will that be a good entry point? give me a break – entering today is at +500 points and entering then is at +700 points. Ride the trend and there is no point early or late in entering or exiting the markets.

- Those who would have followed the markets blindly on the technicals would have been sitting on the right side of the markets and are the only ones who would have made money. Here I am seeing and telling everyone but doing the wrong thing myself. – Never too late to bang your head on the wall and regret I guess.

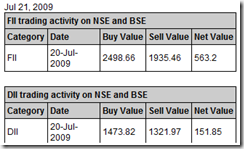

The global cues are wonderful – FIIs buying or selling not withstanding. the entire markets the world over are green. FTSE is +1.25%, Dax closed up 1.04% and Cac closed 1.63% up. The US continued its upward march – Dow 1.19% up, Nasdaq up 1.2% and S&P up 1.14%. The Nikkei has opened up 1.88% and Strait Times is up 0.31%. No sanity as we see the markets as of now.

As I talk about the technicals another wise crack lights up in my head – in a down trend there are no supports – in a upswing there are no resistances – Cheers. There has been no resistance worth talking about that has not been broken and surpassed in half an hour of trading. All the same the markets a have run up crazy and can fall crazy – I feel it is time to be a bit cautious. The markets have rallied right from the bottom of the Bollinger band’s lower edge to the upper edge. The candles had yesterday touched the upper edge and may trail the upper edge. 3 EMA has crossed above the 15 EMA and the buy signal was generated on Friday. Infact the 15 EMA is just a point short of 20 EMA. ADX is rocking and uptrend seems to be gathering strength as we see it on ADX. MACD had the second day of positive divergence and is now formally said that it is bullish. RSI is bullish and had generated buy yesterday. Slow Stochastic are the only ones that can slow this uptrend – being overbought. Infact both %K and %D lines are in overbought territory. TRIX is looking up.

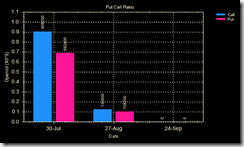

The Global cues are fairly bullish and so are the technicals. The option data does not support too much bullish so all in all – we may be topping up. I will sit another day on the so called sidelines. Cheers – and have a nice trading day.

4 comments:

very realistic expression of predicament of various category of mind sets. My congratulations for the article well written. Keep it up

Cheemaji,

good day.

used to see ur comments on Genius's blog only.

your analysis and approach is fantastic.

regards,

Thanks pop and thanks verma for your encouraging remarks.

Verma: look forward to you on this blog off and on... ;-)

Post a Comment