A breather is what I had expected yesterday after breaching the 3900 levels.

The Global cues are what the bulls would have prayed for with their knees down. These cues will certainly put pressure on the bears today – or perhaps for this week. Let us see them. Europe had opened red/flatish and then as the US cues kept coming in ahead of the important data out of US the markets kept improving finally ending 2 to 3 percent in green. FTSE up 1.82%. DAX up 3.19% and CAC up 2.31%. US too started the day almost flat but then ahead of the data coming out it started recovering – finally ending decisively in the bull territory. Dow was up 2.27%, Nasdaq up 2.12% and S&P up 2.49%. After a week of bull hunting – it is time that bulls also try to show their strength for whatever they are worth and the Asia has opened green. Nikkei is up 2.11% and Strait Times up 1.76%. All this is well but the news out of US is not all that good – mind you their Budget deficit is up 1 Trillion with the fears of it reaching 2 Trillion and there are fear that the dollar as a currency may not perform well in near future.

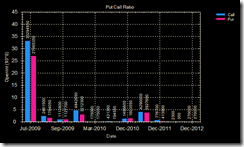

Looking at the Options data – one of the biggest build up of open interest in Nifty is 3800 level and I feel that we are going to be playing in a narrow band till the time this levels is broken on the down side. The banking sector may perform the best in this week during the recovery.

All in all – the global cues favour a recovery – that I had frankly expected yesterday in our markets. Technicals remain weak but as the Slow Stochastic is overbought and bullish – it will help the market recover a bit today. Options have seen the largest open interest buildup at 3800 level that would take time to be broken on the downside. I feel we should remain range bond between – 3800 to 4150 levels for some time. max upside should be capped at 4200.

Best of luck to everyone for today…

| Ser No | Stock/Index | Sold / Bought at | Last Closing | Notional Profit/Loss | Stoploss | Remarks |

| 1. | Nifty | - 50 (4185) | 3974 | +10550 | 4207/4202 | Since I expect the markets to go to max of 4200 levels the stoploss can be kept another 25 points above so that it does not get triggered. |

| 2. | Reliance | Not initiated | ||||

| 3. | Nifty Call | Looking forward to selling Nifty call, strike 4200 when nifty crosses 4150. |

0 comments:

Post a Comment