Wednesday, December 31, 2008

Tuesday, December 30, 2008

Inconsequential day?…

I am on leave in Chandigarh and with four kids running around the house and the Xbox – there is really no time for updating the blog but all the same it has become a habit for me so here I go – up and awake after a late session of Halo3. Why do I call the trading yesterday as inconsequential? because the holiday mood extends and the volumes were fairly thin but the flow of the news regarding the Stimulus package and the rate cut by the banks gave it the push it required for a recovery from the otherwise weak market that was slipping red. See the markets as of yesterday? The markets opened below the Pivot and was testing the Support at 2814 – then as it decided that enough is enough – it broke past the Pivot to go up to the R1 and ended below that. I sometimes wonder how these levels play such an important role at all. One more thing before I go ahead – the charts and markings are by me and they give a rough idea about the session – please do not take them to be too accurate as the lines are placed by me manually.

See the markets as of yesterday? The markets opened below the Pivot and was testing the Support at 2814 – then as it decided that enough is enough – it broke past the Pivot to go up to the R1 and ended below that. I sometimes wonder how these levels play such an important role at all. One more thing before I go ahead – the charts and markings are by me and they give a rough idea about the session – please do not take them to be too accurate as the lines are placed by me manually.

The behaviour of entire Asia was somewhat on the same lines – open weak and then went green. Nikkei closed up 0.09%, Hang Seng up 1.02% and Strait Times up 3.18%. Europe was better than Asia FTSE opened green closed green +2.44%, DAX up 1.63% and CAC up 0.47%. US was weak – actually US will remain weak for some time to come now and no amount of news can contribute in any sense to being good. DOW was down 0.37%, Nasdaq down 1.3% and S&P was down 0.39%. Inspite of all the negativities' the Asia today morning has opened green and climbed to better levels. Nikkei is up 1.28% as of now, Hang Seng is up 0.6% and Strait Times too seem to have made an attempt to go green but remains 0.43% in red.

On the candles yesterday the candle was nice white one but unfortunately could not close above the 20 EMA, The markets trail the mid of Bollinger Bands and the bands remain of somewhat the same width only. The volumes were low and low participation shows. RSI is facing up again but to call it bullish – not yet. Slow Stochastic – both the red and green lines are in the oversold territory and a small bounce back with the help of the was due and may happen again. TRIX has changed its attitude and may change its view to bearish. MACD positive divergence has almost disappeared – but still is alive.

Pivot data… Notice the pivot at the same place as before.

R3 3050 against 3076 Yesterday

R2 3007

R1 2964

Pivot 2888 against 29887 yesterday

S1 2845

S2 2769

S3 2726 against 2698 Yesterday

Projected High Range 2926 to 2986

Projected Low Range 2876 to 2816

Fib Projected High 2963

Fib Projected Low 2779

Best of luck to everyone who is in the markets today – I am out….

Bye

Sunday, December 28, 2008

Major move around the corner… … point is which direction…

Firstly why did the wonderful upmove die? Pakistan crying war? maybe… or perhaps maybe not. It would have been nice had i not been travelling and seeing the debate as to why the markets did what they did last week. There are so many reasons once again to justify both sides of the story really. There is a fiscal stimulus package that seems to be coming in the next week, the advance tax numbers have been low and that does indicate the slowdown that is happening. We have slipped below the 25 EMA that was holding out till yesterday. We have also closed below the midway of the Bollinger bands that does not speak too well about the trend either. The volumes are low so the markets can really be manipulated without really indicating the strength of the trend. In any case the trend as of now can be debated whatever but seems to point down only. There is no real indication of recovery – my problem is that the levels that I have expected the market to move too has not been achieved and this unfortunately is the second time. I guess I should stop looking at those targets – but then the gut say that we will (will) move to a little higher levels than what we have touched now before we see the lows that the markets have in store for us. I am updating this page with little lesser than ideal data that I keep in front of me while I write about the next day. As I had said yesterday I am in a train and the only contact I have with the life line of our generation – called internet is the Tata-Indicom data card and the laptop that is supposed to have 5-6 hours of juice. I am mighty impressed. Before I started on to writing this – since I had not copied the charts and the details – I started to see a movie… “The Constant Gardner” – I have finished with the movie and now I am on to writing this article and the battery is going good.

As far as the global cues go – Hang Seng was closed in Asia on 26th and while Nikkei went up and closed in green up by 1.63% the Strait Times closed in red by about 0.66%. No one out of them that can show us the direction. Europe too was closed – so no cues are good cues… no? Us was in green though the trading was lack lustre with low volumes as most of the traders pr eferred to remain off the hook. Dow closed up 0.56%, Nasdaq up 0.35% and S&P 500 up by 0.85%. But on the real basis the Christmas did not really get any cheer this time.

eferred to remain off the hook. Dow closed up 0.56%, Nasdaq up 0.35% and S&P 500 up by 0.85%. But on the real basis the Christmas did not really get any cheer this time.

Okay there are not likely to be any embedded chart this time. So just visualise ;-). This is the fourth day with the black candle showing us the way to salvation. So that means the Doji that we saw the second time over really did call out the end of the run up. mind you the run up was not bad – from a low of 2502 touched on 20 Nov – up all the way to 3106 high touched on 19 Dec. But I still missed the levels of 3200-3500 I looked forward too. The candle on last closing was bad and black in colour. As I mentioned earlier – we are now below the half way mark on the Bollinger bands and the lower band is trailing at 2517 and that can be our target on near term basis. As the markets go down the lower band will also reduce in value so you can have a fair idea as to where we are heading too if we are to trail the lower Band. See the volumes – no pun intended but we can hit the Dipawali lows if we continue at this rate. MACD divergence is just about in the positive and any more black candle can plunge this also into the negative divergence zone. RSI is going bad at this rate – look it at confidently dipping down. The Slow Stochastics also do not portray a good picture so see it going down? only saving grace is that after the blue line too joins the red line below the 20 marker we will be able to say that the markets are oversold. Till then – you can see it on the charts.See TRIX also carefully – it has stopped going up or shall I say looking up. So the up move seems to come to a halt. Infact now till the new year – there is a virtual holiday going on. So if there is a plan by bears or bulls – they can pull a fast one as the other party sleeps – and that is what the volumes show. The real show will start from January onwards.

Lie Doggo is what I would suggest everyone and wait for some more participants to show some interest in the markets.

Pivot data…

Pivot data…

R3 3076 against 3036 on Friday

R2 3003

R1 2930

Pivot 2887 against 2928 on Friday

S1 2814

S2 2771

S3 2698 against 2820 on Friday

Projected High Range 2908 to 2966

Projected Low Range 2953 to 2895

Fib Projected High 2991

Fib Projected Low 2812

See the Friday’s intraday chart? we never really breached the resistance on the up side but slided below the pivot with ease and went on past the Support 1 to Support 2

Friday, December 26, 2008

Good News….

Okay two good bit of news - one for you and other for me.

I have been sanctioned leave so that means a good break for me....

The good news for you - I will stop boring you in this hopefully nonsense directionless market...

(ps st don't be so sure - I will of-course post whenever I am not travelling)

Meanwhile….

……enjoy the markets.

Thursday, December 25, 2008

The uptrend seems to be dying…. but will it?

What a sad way to see the uptrend that was labouring to be born – dying. Slowly – one by one all indicators are giving way to the onslaught of the bears. I feel sad – there was definitely a steam in this move – but it just does not seem to work out.

The markets in Asia are nothing to talk about. Nikkei up and Hang Seng was mildly in red. Europe too was red. FTSE 0.93% red, Dax was closed and CAC was down 0.39%. There is bleak economic picture in US as the new data comes in – what would you e xpect in such a scenario? the markets closing up – Dow up 0.58%, Nasdaq up 0.22% and S&P up 0.26%. May be they saw too many days of down side and just decided so green tick would be good for a change on eve of Christmas.

xpect in such a scenario? the markets closing up – Dow up 0.58%, Nasdaq up 0.22% and S&P up 0.26%. May be they saw too many days of down side and just decided so green tick would be good for a change on eve of Christmas.

The candles have left the upper edge of bollinger bands and that is not goo.this is fourth black candle by the way.we are below the 5 EMA and going below the 20 EMA. We never crossed above the 50 EMA. Volumes were low. MACD divergence has reduced. RSI going bearish Slow Stochastic bad and TRIX pausing – it may start looking down. Oooof ! that itself is hell of a lot.

Pivot data…

R3 3036 against 3123 on yesterday

R2 2996

R1 2956

Pivot 2928 against 2988 on yesterday

S1 2888

S2 2860

S3 2820 against 2853 on yesterday

Projected High Range 2942 to 2976

Projected Low Range 2960 to 2926

Fib Projected High 2986

Fib Projected Low 2881

See ya tomorrow. Bye!

Wednesday, December 24, 2008

Doubtful Crossroads…..

With the market showing weakness inspite of all the expectations from all quarters - either it is fooling us big time or we are taking it wrong. Why should we fall - there is no reason really - agreed that there is perhaps no reason to go up - but then why should we go down? In any case it is a well known fact that the markets are difficult to predict and more so in times like these where there is extreme fear - or perhaps I can put it across that there is lack of extreme greed - people are stacking away small victories for the uncertain future. Weak global cues saw the Sensex open with a marginal negative gap of 106 points at 9,822 and moved up to a high of 9,838 in morning deals. Selling intensified in noon deals on weak Asian closing, and the index dropped to a low of 9,644 - an intra-day swing of over 190 points. The Sensex finally closed with a loss of 242 points (2.43%) at 9,687. All the sectoral indices closed with losses. The BSE Realty index was down nearly 5%. Market breadth was extremely bearish - out of over 2,555 scrips traded, over 1,745 declined. Satyam dropped over 13% to Rs 140. Jaiprakash declined over 10% to Rs 78. Tata Motors slipped over 7% to Rs 175.

Nikkei was closed today - not that a very bright and sunny day was expected from their part of the country. Hang Seng was down 2.75% and Strait Times too lost a good 1.21%. Was there any chance of going green - not that I can find any reason - the markets infact opened green - trailed along the neutral line but on the negative side and then dipped down greater red before closing. Europe was in the twilight zone - neither here nor there. FTSE was green like rest of Europe for the entire time but dipped very aggressively down barely closing with its head above the water at 0.16% in green. Same story was repeated by DAX and CAC - but unfortunately they could not keep their head above the water and ended 0.21% down (DAX) and 0.73% down (CAC). Frankly I would have called it a flat closing had it not been the sudden and extremely steep fall towards the end of the session for all the indexes. US was not the bad influence - it had infact started out green but towards the mid session all the indexes are down red - Dow down 0.55%, Nasdaq down 0.70% and S&P down 0.59%. The session end is still some time away so the market can frankly swing either side.

With all this doubts floating around it is difficult to take a positive call so instead of taking a call I will just present facts and wait for the markets to what they intend to do – confuse us. On dec 19 – candles made a doji – well it was not really a perfect one but that was the day when the candles left the upper end of the Bollinger Band. The drop then continued for the next two days – building a bit of momentum – growing bigger every passing day. The only saving grace that I see is that the candles closing is still not below the opening of 18th Dec. There was a serious attempt for the candles to cross above 50 EMA. A cross over would have perhaps done wonders but that is not to be and the 5 EMA line is still above 20 EMA so that is all that is left. The volumes were less to say the least – so may be – just may be if the volumes pick up we may go green like hell. MACD red line is still above the green but divergence has certainly reduced. RSI is bearish and looks down. Slow Stochastic is giving a certain sell – having crossed over below 80 line. TRIX still looks up but showing doubts – perhaps a little bit at the moment but doubt nevertheless.

Pivot data…

R3 3123 against 3193 on yesterday

R2 3071

R1 3019

Pivot 2988 against 3058 on yesterday

S1 2936

S2 2905

S3 2853 against 2924 on yesterday

Projected High Range 3004 to 3045

Projected Low Range 3034 to 2993

Fib Projected High 3062

Fib Projected Low 2934

It is the last day to square up tomorrow – so let us see where we go – frankly there should be some lower side before we go up.

This is how the markets traded on 23rd on pivots. It opened below the Support 1 and then never looked up. See it showed signs of recovery at support 2 but breached it during its second attempt.

I will try to include this chart whenever possible.

Tuesday, December 23, 2008

Laboured up-move….

The amount of pain the markets are having moving up seems to be extremely painful and it is no wonder that we are moving at an extremely slow pace upwards. It was expected that the bad news will continue – and the markets will cling and try to whatever good news it gets to inch up. The problem is that the good news is just soaked up like water on sand with little or no effect. The govt definitely wants a rosy picture to be there when the elections storm hits then in their face. The point is that SOPs that they are taking out are not being readily accepted by the industry/markets. Take banks for that matter – the reduction in interest rate is like a thick soup where the main ingredient is lost in the thick gravy. Airlines are hell bent on not giving out any fresh rate cuts inspite of ATF prices falling like anything over past month or two. The left has voiced against the insurance bill. The tussle seems to go on and on.

The Global cues are nothing to talk about really. Nikkei was up 1.57%, Hang Seng down 3.34% and Strait Times down 2.78%. We also dropped as Reliance shed 5%. Europe was weighed down due to banks, autos and oils. FTSE now has dropped 7 days out of 8 last traded days. It has lost 44% this year and hardly heading to ‘Happy Christmas’ The focus now seems to have shifted on what will be offered by 2009. FTSE ended down 1.88%, DAX down 1.23% and CAC down 2.31%. News of Toyota projecting first loss in 70 years due to relentless global slide in car sales coupled with rising yen has shaken up already jittery economy. Not only did it pull down auto shares across the world – it also pulled down the crude by almost 4% –back to below 40$ a barrel. Finally US that had opened flat with negative bias – never saw green the entire trading day and ended with Dow down 0.69%, Nasdaq down 2.04% and S&P down 1.83%.

As far as the candles are concerned – we have entered a phase of low volatility – the ATR (average true range) for past ten day period on nifty has dropped to 120 from 230+ a month and a half. On the lighter side – till now the investors were loosing money – now traders are also loosing to the broker houses. The candle was black and seems that some profit taking is kicking in – We have only two days now left for the expiry. I really hope like hell that the expectations of short covering do not die like last to last month where the expiry came and went and there was nothing that happened. We are trailing between 50 EMA on top and 25 EMA below. The 50 EMA is what I would like to be below – only then new higher levels can be thought about. The volumes were miserable to say the least on nifty. Bollinger bands are expanding a bit and MACD divergence has once again increased – showing that yesterday’s profit booking or whatever did not do any damage. RSI still is good and %K and %D line of Slow Stochastics are trailing on 80 – just below the overbought levels. TRIX is still looking up. Saw yesterday? the nifty hit the R1 and then promptly settled down at lower levels. Jaggu’s TRIN is bullish – so not to worry at the moment.

Pivot data…

R3 3193 against 3176 on yesterday

R2 3141

R1 3090

Pivot 3058 against 3073 on yesterday

S1 3007

S2 2975

S3 2924 against 2970 on yesterday

Projected High Range 3074 to 3116

Projected Low Range 3104 to 3062

Fib Projected High 3132

Fib Projected Low 3004

China has cut interest rates – so that should matter and Asia is down.

Monday, December 22, 2008

Capital preservation….

I never really gave a thought to capital preservation till now. It really never mattered before – the going was so good that it really did not matter whether you planned anything or not. Pick up junk for whatever you feel it was worth and it would turn out to be Midas's touch. So a generation of investor got used to just putting money in stock markets – there was nothing called investing – I was surprised when one day I was nominated a so called investment advisor by ICICI Bank and wanted to tell me to invest (Somehow they classified me as a HNI – that itself was the joke of the year). Anyway when I sat with him and grilled him for some time – his advise was to buy this – buy that and that. I was shell shocked that day – this guy had no entry policy and worst had nothing in his kitty there was called as exit strategy. See the genesis of problem with ICICI Bank – expansion without matching expansion of quality man resources – Anyway I will not dwell any longer than this into ICICI Bank – my aim is not Bank thrashing at the moment. Since I had seen some ups and down’s in the market at even without having a policy myself – I was sure that anyone who was supposed to advise me should atleast have a theoretical knowledge more than me. Any way this was true not only for him but for most of us – the retail investor, the investment advisor and tons of others not to miss the advisors who used to come on to the idiot box every morning and go on and on and on – blah blah blah. There was a buy recommendation, hold recommendation and recommendation to sell only to move to some other share/stock. There was no advise that told the investor to take out some money from the markets – do a risk assessment or to set goals. That is the reason that our loss ran on and on.

Well now that we have burned the fingers – let us see what we can do. I am in the middle of reading a book on investing and he say something that struck to me as a wonderful advise. He says study what others do for themselves but at the end of the day see what strategy suites you and then stick to it. What it means is that inspite of what I say or someone else says – at the end of the day – since the money is yours – the risk is yours so you have to choose what is right and what is wrong with your approach to making money. Then he went on to say that risk profile yourself. That can be done online by a number of sites. They ask you questions like your age bracket, current salary and so many other questions and then tell you a ratio – your savings should include – for example 70% should be in risk free low return investments/instruments, 20% in so and so and balance 10% in stocks. Now here lies our problem – see if I was to restrict my investment in stocks of 10% of my total savings – and the going goes good then it is well within the right to increase the percentage to 12 or 15% – but it does not happen like this – we generally then start pulling out our resources from the otherwise safe investments and pump into stocks. It is here that the hurt lies. So let us see how we manage money – firstly our proportion will increase without doubt – as the investments give good returns the proportion will increase so ideally if we had planned it 10%.it will grow – so now one should allow it to grow – but at each stage – take out some profits and put them in non volatile instruments – bonds/FDs/postal deposits etc. now there will be a symmetry of growth in both the – high risk and low risk side of investments. It is so basic that we overlook it and land in trouble. It has to do with one of the two things – the greed and fear. I followed this policy and had a full 100% reserves. I should be rich as per this philosophy – but my greed and fear made me break one FD after another and sink it in the market not realising that there is no bottom. So inspite of having a wonderful strategy I could not make use of it and suffered. In the end – I urge you to make a strategy and stick to it – have to do mind training the yoga way I guess.

The global cues were once again mixed on Friday but if the bulls have held out so long – and if they may hold o

As far as the candles are concerned – they continue to hug the upper limit of Bollinger bands with the bands expanding and 5 EMA trailing comfortably above the 20 EMA line. The next great thing would be if we touch and do a 50 EMA crossover (See the purple line in the chart – that is 50 EMA). The volumes were certainly more than the average that we have been seeing in the recent past. MACD positive divergence continues but has reduced a bit. RSI continues to be bullish. TRIX still looking up and MACD showing doubts whether to remain in overbought territory for some more time or to fall down. The fall will come only with market falling overall.

Pivot data…

R3 3176 against 3222 on friday

R2 3143

R1 3110

Pivot 3073 against 3018 on friday

S1 3040

S2 3003

S3 2970 against 2814 on friday

Projected High Range 3091 to 3126

Projected Low Range 3085 to 3050

Fib Projected High 3125

Fib Projected Low 3016

Even the Supports have moved up into the 3000 zone – so improving with baby steps – but improving all the same. Best of luck everybody.

Friday, December 19, 2008

Shucks… ran out of idea for header…

Being late for posting is becoming my habit only – actually my brother, his wify and kids are here and I run out of time in the evenings. I apologise for this behaviour of mine and will try to post be evening. Actually Sangat also affects – Jaggu (I am referring to you).

The battle was finally lost by the bears yesterday – they did attempt to take the markets lower – but I guess the bulls were smart enough to hold on to the levels – and that created short covering. If we do have some more steam left – then that along with the short covering should still carry us to a little better levels. The fall in inflation is much beyond the short term expectations and that is what would have given steam for the upswing yesterday. There are many like me who have a lot to gain if we go to higher levels. My advise would be – be patient – do not start taking out the money at this level. we are surely to see better times than this. The crude is down to 36$ a barrel. We will propel forward on these news – crude, inflation, expiry next week and elections alone. The global cues will create havoc with this little plan of mine but that may happen still.

Infact the global cues still do not point to any particular direction and the confusion remains. most of the movement is not in a particular direction with conviction. One index is up the second down and that to on or about the flat line most of the times. The bad news abroad is just not finishing. The Europe – my favourite punching bag – that takes cues from Asia and US both remains to be number one in the confused state. FTSE up 0.15%, DAX up 1.02% and CAC 0.24%. So Bush finally decided not to go ahead with his so called dishing out money to the poor Auto Makers and is now considering ‘Orderly’ auto bankruptcy. The signal is without any doubt points towards still deteriorating economy. The US markets made an attempt to remain around the zero level but failed in doing so by the mid session and closed red like in chilly red. Dow down 2.49%, Nasdaq down 1.71% and S&P down 2.12%. Now that would have and did effect the opening in Asia. But the markets have since recovered from the lows. Nikkei is now only 0.21% down, Hang Seng down 1.54% and Strait Times in green 0.55%.

I am just crazily confused as far as the candles are concerned. Bearish engulfing one day followed by bullish engulfing the second day – what do you expect me to say actually? I am confused but then we can talk about the non confusing issues – like the Bollinger bands are widening and the widening is with the candles on the upper limit – so we may see the continuation of uptrend still. 5 EMA is still above the 20 EMA. Volumes were better than average. MACD divergence into the positive side – so far so good. RSI looking up and good again. TRIX as good as ever. Slow Stochastic shows the red line about to attempt to cross the blue line again – again it might remain in this overbought state for a day or so.

Pivot data…

R3 3222 against 3209 on yesterday

R2 3168

R1 3114

Pivot 3018 against 2991 on yesterday

S1 2964

S2 2868

S3 2814 against 2773 on yesterday

Projected High Range 3066 to 3141

Projected Low Range 3003 to 2928

Fib Projected High 3112

Fib Projected Low 2881

Notice the Fib projected high remains same today but the pivot is above 3000 and R3 moved in 3200 levels.

FootNote: I will no longer be posting the articles on TheIndianStocks as self and Aryan – the host of the site has a difference of opinion that does not have a middle ground.

Thursday, December 18, 2008

Confused?…. don’t worry …. you are not the only one…

Markets are seeking direction and there is confusion galore… it is not that the confusion is our state of mind only. It is so in rest of Asia, Europe and US. So many things are playing on the mind of investors perhaps. Is it to get any worse? The markets are generally known to take a view forward – that is a quarter, perhaps a few quarters ahead – but for the markets to have confidence in that future outlook just does not seems to come. The bad news just keeps on getting worse. The good news hardly gets bigger or better. So we are in a hang fire where the technical try to take us to higher levels and the fundamentals pull us down. Remember what I had thought loudly yesterday on the reduction of interest rates in US? the debate around the same points is there now in US and the euphoria of 0% rate of interest and the utility is being questioned and the markets fell – well not really hard but the kind of upswing they showed on the announcement of the same is down and out – now this debate will continue and let us see where we reach when we are at the end of the road.

I am already late in posting this so I will hurry up and leave touching controversial thought process to myself. The markets yesterday were cautious to say the least – they kept both bearish and bullish well within the striking distance – and atleast as far as we were concerned struck and went the bearish way. Europe was also in the same state – FTSE opened green – fell down and then recovered to the flat line closing just 0.35% in green, DAX was down 0.46% and CAC was in red 0.30%. US opened red – closed red red with a good attempt to go green. Finally Dow closed 1.12% in red, Nasdaq down 0.67% and S&P down 0.96%. The confused state in Asia in the morning opening today continues. Nikkei is green less than a percent, hang Seng too was green but red by half a percent point and Strait Times is just about green and looking down.

The state of affairs on the candles have turned from all bullish to mixed now. The candle was black and it missed engulfing the previous candle by 2 points otherwise it would have been a good bearish engulfing pattern. What are two points within good friends? we will call is bearish engulfing pattern. The Bollinger band has expanded a bit and 5 EMA still trails comfortably above 20 EMA and the candles trail the upper edge. The volumes were more than recent average and I will be posting the averages figures (comparative) from tomorrow onwards. (just came to know how and where to look up the figures from! Okay the bad news first – the Slow Stochastic have given a signal that is used by many traders to sell the positions. Apart from that the RSI is actually not too enthused. MACD divergence remains positive and at the same place we left them yesterday. TRIX still looks up and refuses to show doubts on the run up. Take your pick of being a bear or a bull now.

Pivot data…

R3 3209 against 3141 on yesterday

R2 3124

R1 3039

Pivot 2991 against 3081 on yesterday

S1 2906

S2 2858

S3 2773 against 2896 on yesterday

Projected High Range 3015 to 3081

Projected Low Range 3070 to 3004

Fib Projected High 3112

Fib Projected Low 2906

The range has increased – the upper band going up and lower band going down. Pivot too has moved down almost a 100 points – another interesting day in our hands. Best of luck…

I will no longer be posting the articles on TheIndianStocks as self and Aryan – the host of the site has a difference of opinion that does not have a middle ground.

Wednesday, December 17, 2008

Feeling confident?…

For 17 Dec 08

Slowly the tables are being turned and day by day the confidence level is being taken to the new highs – infact there was already apprehension in one of the minds on idiot box that we might have seen the bottom – wait – this is exactly the game plan. This is exactly what I have been saying for past so many days – our next fall will be when all have jumped on the train and is confident of a good rally – if you see it - I am sure you will find it sickening. Go with this rally – to wherever it takes us but remain very very very very cautious as we reach 3200 or 3500 levels. I am sure that we will go there and I am pretty sure that we will return from there. Infact it may be a time to selectively exit in the coming few weeks and sit tight for some time. Till that time/levels come – continue riding up. The markets shed its confused state of mind yesterday and have shown a good green tick. It did so on slightly less volumes. But then as long as it went up.

The news of the day was stolen by US by reducing the benchmark rate to 0% to 0.25% from earlier 1%. I did not have enough time to study what will be the repercussions or how it effects them – but I derive only this from my glance at it – two things – firstly, they are in deeper trouble than what we will ever see till that hits us in our face – secondly, there is nowhere to go now as far as benchmark rate reduction goes – this is the bottom – unless now they come up with something that Fed will pay from its pocket for taking money from them. I am sure that they would know this and I am sure that there will be many tricks up their sleeves – but again this it – in this particular case – they are at point Zero. The US markets reacted and closed all the way up in green but personally I would not be too happy and may like to wait for the true reaction as these facts sink in.

Well on the global from the global cues the story goes on like this – Asia was mixed with all colours visible – Nikkei red 1.12% down,  Hang Seng green 0.55% up and Strait Times green 0.41%. Europe was green FTSE up 0.74%, Dax up 1.61% and CAC up 2.07%. The Europe had infact oscillated around the flat line with positive bias before it finally closed green ahead of the Fed decision in US.US was mildly positive till the time the Fed decision came – then it shot skywards with jubilation – Dow up 4.2%, Nasdaq up 5.41% and S&P up 5.14%. Ofcourse it will get more interesting now onwards.

Hang Seng green 0.55% up and Strait Times green 0.41%. Europe was green FTSE up 0.74%, Dax up 1.61% and CAC up 2.07%. The Europe had infact oscillated around the flat line with positive bias before it finally closed green ahead of the Fed decision in US.US was mildly positive till the time the Fed decision came – then it shot skywards with jubilation – Dow up 4.2%, Nasdaq up 5.41% and S&P up 5.14%. Ofcourse it will get more interesting now onwards.

Our candles are swinging the colour remains white and testing new levels – I do see as small trouble just short of the 3200 mark – but should be achievable. The Bollinger bands have widened and 5 EMA line is confidently above the 20 EMA. The MACD divergence has remained same – food for thought – why should it remain same to yesterday? RSI is good without doubt – and TRIX is even better – just short of the 1 mark and looking up. See I have had a lot of confidence in the indicator and it did indicate in advance the trend – good. It still looks up. it is the Slow Stochastic that is bugging me – Red line trails above the blue line and both in overbought territory. Again a brakes here for a day or so may be good.

Pivot data…

R3 3141 against 3107 on yesterday

R2 3107

R1 3074

Pivot 3081 against 2970 on yesterday

S1 2985

S2 2929

S3 2896 against 2833 on yesterday

Projected High Range 3046 to 3091

Projected Low Range 3013 to 2968

Fib Projected High 3076

Fib Projected Low 2938

If we open with a huge gap up then I will not be too enthused by the markets – but if they open around the flat line with positive bias – then it will touch another high today. By the way it closed at the highest point yesterday – it is only after adjusting the closing point that market was down 11 points.

Tuesday, December 16, 2008

An Appeal....

I have in mind to make a widget for the blog - it is a simple idea but skills to write html code will be required - if you can help me please leave your mail ID/mobile no in comments - I will contact you.

Sure and steady….

Conflicting views on the direction our indexes will take in short term has created confusion but the markets are weathering all storms and moving steadily up – a small step at a time – beating bears here – killing them there. But every time it has defied the bears – every time it has taken a step to go up – it has been little less than expected by me. I did not perhaps realise that the bears are strong and cash rich. But my assumption was based on the fact that they have to let the bulls go to some heights before they meaningfully cull them. It may be actually that the bulls too are wary of each step they take. All said and done – I was of the opinion that the markets will go in the range of 32 to 35 hundred on nifty before the serious selling will set in. – Culling of bulls I meant. So we have some time to go before we reach there – one step at a time. I still stand by the figure I gave above. Now only markets have to prove me right – or wrong.

There was nothing really good about the global cues or the markets. Infact we should see the weakness shown by the world markets somewhat magnified in our trading today. Asia was weak – except ofcourse our markets. Europe opened green then steadily slipped in red – at one point diving deep down then recovering close to the flat line but in red. FTSE was 0.07% red, DAX was 0.18% red and CAC closed 0.87% in red. US struggle continued with the fate of the automakers still hanging on a thread and while the comments were there to signal and calm the frayed nerves of the investors – there were no details on timings, amount or the term of the package to the big three daddies of US auto industry. While the General motors and Ford finished the session a few points in positive (0.14%) to be precise, The US indices traded in red. DOW was down 0.75%, Nasdaq down 2.1% and S&P down 1.27%.

The candle formed was white and good. The Bollinger bands have expanded a bit and the Candles are along the upper line of the bollinger bands. 5 EMA line is above the 20 EMA line. The volumes were same as yesterday. MACD positive divergence has increased and the goodness continues. RSI is good and so is TRIX. Now the problem – MACD red and blue lines are in overbought zone and they do not intended remaining there for too long. That is the way so just a time before it drops (taking the markets down with it) Also the red line has already looked down attempting a crossover to the lower side. Another negative day in making today? Let us see.

Pivot data…

R3 3107 against 3060 on yesterday

R2 3065

R1 3023

Pivot 2970 against 2889 on yesterday

S1 2928

S2 2875

S3 2833 against 2719 on yesterday

Projected High Range 2996 to 3044

Projected Low Range 2980 to 2932

Fib Projected High 3037

Fib Projected Low 2891

Expected opening with weakness and may recover towards afternoon. Notice that the resistances have moved – all above 3000. R3 is now infact moved to 3100 levels. Best of luck everyone.

Sunday, December 14, 2008

Making money….

I was interacting yesterday with some friends and we started discussing stocks. The talk naturally moved on to  how many have made money in the markets. The story was simple and was repeated so many times. I was doing so well till Jan this year and now I am down to 45%(best performing), 20%, 10% of the money I invested. Basically everyone had lost. Then like a miracle – one of them raised his voice – cleared his throat and said – “.. gentlemen my father is a financial wizard .. he is the man who has made money not only when the markets had gone up – he still makes money when the markets are down in the dumps..” a few jaws dropped – including mine and we all waited eagerly to jot down the notes. He continued “…he has a secret weapon that he does not share with anyone but only with me and today I will tell you his strategy…” “ and his strategy is -- invest in Govt Bank FDs…” - WOW that is the voice of a true Indian of his generation. That is exactly why a generation gives a damn whether the markets go up or down… unfortunately this is the exact reason why the other generation has suffered – they took no heed to the words of wisdom and wanted to become financial wizards themselves overnight. Over leveraged in the markets where as any management guru worth his salt will profile your risk taking capacity and then put you with this profile in a band and give you a break up of what and where you should invest – FDs, Bonds, low risk securities, Insurance and then stocks – generally 5-10 or 20% of your portfolio .. and in that a very small portion – probably in derivatives – but the greed took control of logic and here we are – a group of looser finding ways and means to make money. See – I can assure you – if we have the will and intelligence to continue then it is just a matter of time before we start making money. There is rule somewhere – 80% of the money is made by 20% of investors. So all you have to aim for is to be in this 20%. I would have loved to talk about a strategy on capital preservation in good times and bad times – running out of time now – some other time perhaps.

how many have made money in the markets. The story was simple and was repeated so many times. I was doing so well till Jan this year and now I am down to 45%(best performing), 20%, 10% of the money I invested. Basically everyone had lost. Then like a miracle – one of them raised his voice – cleared his throat and said – “.. gentlemen my father is a financial wizard .. he is the man who has made money not only when the markets had gone up – he still makes money when the markets are down in the dumps..” a few jaws dropped – including mine and we all waited eagerly to jot down the notes. He continued “…he has a secret weapon that he does not share with anyone but only with me and today I will tell you his strategy…” “ and his strategy is -- invest in Govt Bank FDs…” - WOW that is the voice of a true Indian of his generation. That is exactly why a generation gives a damn whether the markets go up or down… unfortunately this is the exact reason why the other generation has suffered – they took no heed to the words of wisdom and wanted to become financial wizards themselves overnight. Over leveraged in the markets where as any management guru worth his salt will profile your risk taking capacity and then put you with this profile in a band and give you a break up of what and where you should invest – FDs, Bonds, low risk securities, Insurance and then stocks – generally 5-10 or 20% of your portfolio .. and in that a very small portion – probably in derivatives – but the greed took control of logic and here we are – a group of looser finding ways and means to make money. See – I can assure you – if we have the will and intelligence to continue then it is just a matter of time before we start making money. There is rule somewhere – 80% of the money is made by 20% of investors. So all you have to aim for is to be in this 20%. I would have loved to talk about a strategy on capital preservation in good times and bad times – running out of time now – some other time perhaps.

There was a flow of news that kept the markets at the good levels last week – one was the 100 basis reduction in repo and reverse repo rate. Then the government unveiled a 307bn fiscal stimulus package. Next came the much awaited reduction in petrol and diesel prices. Last but not the least was the government plans to accelerate the investments in the infrastructure. This has translated into a package close to 100 Billion Rupees. This made the Reality, metal, auto and banking to stage a strong rally. IT was the factor that has lost out in this race and closed negative. Pharma was the next looser.

We were the best performers in Asia – simple. Asia fell like a hot brick. Nikkei down 5.56%, Hang Seng down 5.48% and Strait Times down 3%. Europe also did not do particularly well closing anywhere from 2 to 2.5% in red. FTSE was 2.47% red, Dax down 2.18% and CAC down 2.8%. The bad news in US continued and markets continued doing the dance as in Sharukh’s Rab-ne… – but people seem sick of bad news and eventually – steadily climbed in green ending – Dow up 0.75%, Nasdaq up 2.18% and S&P up 0.7% – yes you read it correct – they went green. And now the confusion begins as to where are we going to go on monday!

There was a fierce fight between the bulls and the bears. Two Dojis’!! But unfortunately I strongly feel that they do not go well for the bulls – the only factor if any will be the other indicators that are glowing green. Also it is just a matter of a few points and its appearance after a run up otherwise the Doji would have neatly been classified as a Dragonfly Doji – and that is a good bullish Doji. But since it fails on these points – I am confused. The Bollinger bands are narrowing still – cannot say that they are anywhere at their historically narrowest level – but all the same – the break out may be violent – whichever side – or whoever wins – the Bulls or the Bears. The 5 EMA red line is above the blue line and sits there with confidence. MACD divergences is virtually the same as yesterday and as positive. RSI is good but has taken a break - now flat but remains bullish. Slow Stochastic is in overbought zone – both the %K and the %D lines. However red line continues to be above the blue line. TRIX is looking up and is very very good – I wonder why should you short with these indications. What are the bears doing? waiting for some better opportunity? Ummm! food for thought – they can make us fall harder only if we go up – so bulls are taking the line – and up we are likely to go eventually.

Pivot data…

R3 3060 against 3029 on friday

R2 30013

R1 2967

Pivot 2889 against 2908 on friday

S1 2843

S2 2765

S3 2719 against 2788 on friday

Projected High Range 2928 to 2990

Projected Low Range 2881 to 2819

Fib Projected High 2969

Fib Projected Low 2778

Interesting – Pivot has shifted down and the range between the R3 and S3 has increased. It would be interesting to see the outcome on monday – best of luck everybody.

Friday, December 12, 2008

ShoutBox

Sorry gentlemen and ladies who visit this blog - the shout box that I had placed was being misused for placing irrelevant material and ads and has been removed permanently.

Thanks

Cheema

Time to wait…. Time to watch….

The link to visual guide is http://flowingdata.com/2008/11/25/visual-guide-to-the-financial-crisis/ Somehow the jpg is just not behaving.

So our expecting that the run up will take a breather was not a bad call. It had to and the way actually we have closed is not encouraging. I had expected the market’s to go a little bit further up before closing.  In all the probability then it will go lower tomorrow. There are actions taken and news flowing on daily basis – that is exactly what was expected – close to the elections the govt will keep the momentum of news flow to continue and that would have ideally let the markets and the economy in a fairly buoyant state. Now the problem is that the govt is declaring the SOPs but the industry is not really towing the line. Take for example the rate cuts – so many promises and the banking sector is still defiant really – they have refused reduction in rates for one reason or another. Finally I believe that the consensus has been reached and some thing floating on the idiot box – 7% rate of interest for loans upto 5 Lacs and 8 or 8.5% from 5-20 Lacs. I am sure that the govt would have done its homework and the idiot box too was saying that 85% of home loans fall in these categories – what I am worried about is = will this amount to subsidy? what part will be financed by the govt and how. And at the end of the day will the real estate sector really benefit from this? Yesterday I came across this visual guide to the financial crisis in US. take a look at it – just as we are doing – there was just no acceptance of the fact that the problem is at hand till the time it was too big to handle really – see the phase of ignorance we are going through? We too are just not ready to accept that real estate is extremely vulnerable at the moment and you cannot expect closing the eyes to wish the problem away. I am sure that we as general public would not be knowing the real inside to the under currents in this sector – but I am sure the right people would be knowing it exactly how big the problem is and in which direction we are heading. Meanwhile in US there has been no respite at all to the bad news – increase in unemployment data and further job cuts. Bank of America has indicated to cut upto 35,000 jobs over the next three year. Let us assume that at some point of time the job cutting will stop – but will that mean that new jobs are created for the next generation? Uh! food for thought. The package to the Auto sector is encountering resistance at the senate and the low sales is already giving sleepless nights to the auto makers there.

In all the probability then it will go lower tomorrow. There are actions taken and news flowing on daily basis – that is exactly what was expected – close to the elections the govt will keep the momentum of news flow to continue and that would have ideally let the markets and the economy in a fairly buoyant state. Now the problem is that the govt is declaring the SOPs but the industry is not really towing the line. Take for example the rate cuts – so many promises and the banking sector is still defiant really – they have refused reduction in rates for one reason or another. Finally I believe that the consensus has been reached and some thing floating on the idiot box – 7% rate of interest for loans upto 5 Lacs and 8 or 8.5% from 5-20 Lacs. I am sure that the govt would have done its homework and the idiot box too was saying that 85% of home loans fall in these categories – what I am worried about is = will this amount to subsidy? what part will be financed by the govt and how. And at the end of the day will the real estate sector really benefit from this? Yesterday I came across this visual guide to the financial crisis in US. take a look at it – just as we are doing – there was just no acceptance of the fact that the problem is at hand till the time it was too big to handle really – see the phase of ignorance we are going through? We too are just not ready to accept that real estate is extremely vulnerable at the moment and you cannot expect closing the eyes to wish the problem away. I am sure that we as general public would not be knowing the real inside to the under currents in this sector – but I am sure the right people would be knowing it exactly how big the problem is and in which direction we are heading. Meanwhile in US there has been no respite at all to the bad news – increase in unemployment data and further job cuts. Bank of America has indicated to cut upto 35,000 jobs over the next three year. Let us assume that at some point of time the job cutting will stop – but will that mean that new jobs are created for the next generation? Uh! food for thought. The package to the Auto sector is encountering resistance at the senate and the low sales is already giving sleepless nights to the auto makers there.

Asia was mixed – the entire global indexes are taking a breather – good for everyone – baby steps up are anyway better to giant leaps. Nikkei closed in green 0.70%, Hang Seng up 0.23% and Strait Times down 1.51%. All had dipped lower before closing at fairly higher levels – like us. Europe continued with this uncertain trend FTSE closing 0.49% up in green and Dax and CAC ending 0.78% and 0.43% in red. It is finally the US that has thrown in the towel to this upswing and markets closed in red – Dow down 2.24%, Nasdaq down 3.68% and S&P down 2.85%. Asia has opened red as expected – Nikkei about 2.5% down and Strait Times down 1.25%.

On the charts it was a Doji – a reversal signal. It is a candle that shows that the bulls and bears had a good fight and the result was indecisive. In any case it has the power to put to end – what ever trend that was stronger at that moment of time. Upswing – was our pace – wasn’t it? So do we spend a little bit of more time here? maybe. So brace yourself for the halt at this station for some time. The Bollinger bands have constricted further giving a hint that the market may remain range bound for some time and then viciously breakout. The 5EMA line continues to trail above the 20 EMA line and the Volumes were good. Take it as a fierce battle between bulls and bears. The MACD divergence has increased further. RSi is still looking good the red (%K) line has reached overbought zone and the blue line is following closely. TRIX is still looking up. All in all this halt at this level should ideally be temporary with we continuing upwards – mind you that is ideally – and the markets are not ideal most of the times.

Pivot data…

R3 3029 against 3095 yesterday

R2 2992

R1 2956

Pivot 2908 against 2884 yesterday

S1 2872

S2 2824

S3 2788 against 2673 yesterday

Projected High Range 2932 to 2974

Projected Low Range 2915 to 2873

Fib Projected High 2967

Fib Projected Low 2838

If you have been following the pivot charts then you will realise that the range is becoming narrower by the day. Another news is the crude inching up – it is important to see where we stabilise eventually.

Thursday, December 11, 2008

WoW… that’s a wonderful run up…

Want a controversial controversy? Watch http://video.google.com/videoplay?docid=1954933468700958565&hl=es

Before I start with writing the blog – I would like to tell you that this is my 150th post on this blog – meaningful or not – there were so many times when I though that this is a waste of time to share my experiences as they do not matter – but then I am typing my a hundred fiftieth post and somehow that makes be proud in some sense. I have survived so for so long. Hope I continue getting moral help to continue with same vigour.

So the past few days did turn out to be good – mind you that barring small breaks in-between this sun up should still continue – at the most touching a small low of 2800/2900 at the most. There is an environment that wants this bear market behind us. Tough at the end of the day the bears will still play havoc – but like they say – make hay while sun shines. Infact this is not happening only on the our national scale – this is on the global scale – month after month – week after week – bad bad bad and then a relief. Ideally this was expected some time back but it has come now –at a time when other small but significant news and events are with this rally. Out govt along with many others are taking steps to sort out the issue. Oil is touching its all time low. Elections and expected dynamism of Obama, all countries in some way or other doing what can be done to contain the damage. Mind you all this will take its time to show up in the markets and the economy in general. If we do classify this as one of the worst recessions in the history then the bad news is yet to actually come in. The real estate has been a mute spectator standing on the sidelines and standing stout – hardly rolling back the prices, the uncertainty of the job cuts will next figure up when there is a significant reduction in salaries of those who are not shifted to the unemployed line – under threat perhaps to be the next to be sorted out. That fear of job cuts and salary cuts will force the people save for the uncertain future – the spending will further fall – and that will snowball into further deepening recession. Ah! worry not that is still some time away – but do not forget that all rises will be sold into and ultimately we will touch lower than before levels.

The Global cues continue to be good at the moment. Asia closed – Nikkei up 3.15%, HangSeng up 5.59% and Strait Times up 3.83%. Europe is the first one to doubt and seems that it has not been able to digest this run up – Europe remain confused. FTSE was in red 0.32%, DAX up 0.54% and Cac up 0.68%. All the doubts created by Europe will be put to rest if we see US closing well in green – that seems like a possibility so far. At the moment the US after opening in green has crossed the mid session remaining in green by about a percentage point. It is now that it seems to show some doubts of continuing in green. The Indexes are looking like going down - will just have to wait and see where we go by the end of their session.

On the Charts the candle was good and white and confidently crossed the middle of the Bollinger band. Remember last time the candles turned back from the middle of the bands. This time it seems as the candles have the capacity to touch the upper band. The upper band is at a few points above 3000 and be careful if we reach that level. I do not see the candles being violated on the upper side. The 5 EMA has crossed over comfortably the 20 EMA line and many would actually see this as a point to enter market – in longs. Some guts they have though technically they are right. The volumes were higher than the recent past few days. MACD divergence has increased with the Red line increasing the distance between the red and blue line. RSI is GOOOOOOOD and so is Slow Stochastic. TRIX is looking up like staring the stars.

So expect for a small breather the upswing should ideally continue.

Pivot data…

R3 3095 against 3008 yesterday

R2 3039

R1 2983

Pivot 2884 against 2786 yesterday

S1 2828

S2 2729

S3 2673 against 2564 yesterday

Projected High Range 2934 to 3011

Projected Low Range 2868 to 2791

Fib Projected High 2982

Fib Projected Low 2742

Okay I will look out for two very important levels where reversal to what ever is the starting trend should be the turn about point. If the market opens green then the level I will watch out for is 3039 and if it opens in red then I will look out whether the level – 2828 holds.

Wednesday, December 10, 2008

Continuation of classes where Jaggu left……

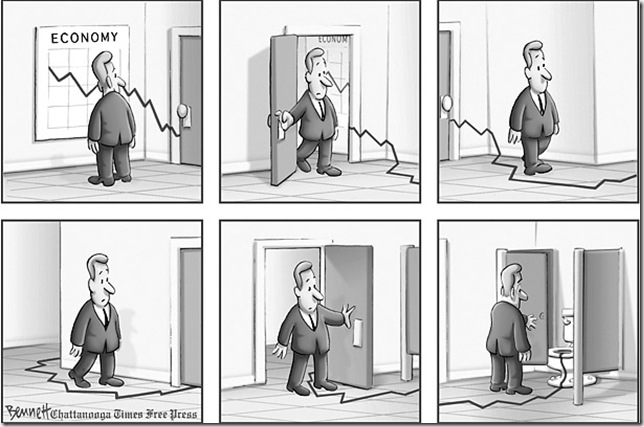

Some Acronyms expanded

BSE = BOMBAY SE EXIT

NSE = NATION SE EXIT

NIFTY = NO INCOME FOR THIS YEAR

FII = FRAUDULANT INTERNATIONAL INVESTOR

PE = PLUNGE ENDLESS

EBITDA = EXIT BEFORE IT TUMBLES DOWN AGAIN

HNI = HAS NO IDEA

PMS = PRE-MEDITATED SCAM

SIP = SUICIDE by INVESTING PATIENTLY

CORRECTION = THE NEXT DAY AFTER YOU BOUGHT SHARES

MOMENTUM BUYING = THE FINE ART OF BUYING HIGH AND SELLING LOW

VALUE BUYING = THE FINE ART OF BUYING LOW AND SELLING EVEN LOWER

CEO --Chief Embezzlement Officer.

CFO-- Corporate Fraud Officer.

BULL MARKET -- A random market movement causing an investor to mistake

himself for a financial genius.

BEAR MARKET -- A 6 to 18 month period when the kids get no allowance, the

wife gets no jewelry, and the husband gets no sex.

VALUE INVESTING -- The art of buying low and selling lower.

P/E RATIO -- The percentage of investors wetting their pants as the market

keeps crashing.

BROKER -- What my broker has made me.

STANDARD & POOR -- Your life in a nutshell.

STOCK ANALYST -- Idiot who just downgraded your stock.

STOCK SPLIT -- When your ex-wife and her lawyer split your assets equally

between themselves.

FINANCIAL PLANNER -- A guy whose phone has been disconnected.

CASH FLOW-- The movement your money makes as it disappears down the toilet.

PROFIT -- an archaic word no longer in use

Finally…. the markets behaved…

It was disgusting like I have said so many times before the way our markets were behaving – but why should I get disgusting – this was exactly how the markets were behaving in the so called secular bull run. There were no fundamentals supporting the kind of run up that was there and the stocks just refused to slow down or pause on their run up. If that was so then why should the markets listen to us on their way down – they should now not listen to any good news coming their way and continue their fall. So far so good. But then there should have been a breather and it is that overdue breather from the fall that we were really looking forward too. That has come so like I have been saying for so many days – it is just to sit back and watch if you were not already long and wait for the wonderful time to short – nothing really can substitute for patience at all. See going by the pure physical data for the last four-five months I have come to a conclusion that the market has moved in a range – depending upon a month anywhere from 500 points to 1000 points. Take a pick at two such points – technically speaking – and we see that we went long in one case with a single CA/PA – and suppose the point was not the bottom – and we paid a premium of 100 odd points for a fairly close CA/PA – then by the end of the month we had at the most lost the premium paid or if we were lucky would have made 20 K in 500 point rally and max about 45 k in a thousand point rally. (Please do take the trouble of defining the rally >> index going up and the rally >> index going down) Now don’t be impressed by such mathematics and good looking calculations. The fact is that I did not made any money – or let me put it this way I did not make as much money. But why? because I lack a control over myself, I am fickle minded, I let my losses run till I am out of money and would have cut the profits when the market was just making the move. Uh!! Only this? well not really – I am afraid at one moment and greedy like a dog at the other moment. Then why the hell cannot I remain away from all this. Because I feel that I can win/I feel I can make a lots of money/I love gambling/I made money last year. WoW – that are all looser scripts. What is missing in them? The definite will to win/a plan to make it happen. What is planning? having a good charting software? Planning that I will make money? Putting in hard work? What kind of hard work? I do not lack a single bit on all of the above accounts – but still I did not win – I made small money okay – but I did not win.

Now here I come to the next part – We are here as an online community to learn and teach. And if that makes anyone of us win and take home a killing – it would be the greatest gift of my life – mind you I am talking about anyone taking home profits and not me! I will do it eventually and I have decided upon it a long time back. I have a score to settle with these DIs, FIIs or whosoever took my money for past one year. I had decided that eventually I will graduate on to giving calls – I mean buy – sell. but in the past eight odd months of blogging I am still some time away to do that. There will be a time – till then bear with me.

I nave now two days worth of story to tell you. The Global cues…. well the Asia was good the first day over. Nikkei had ended 5.2% up, Hang Seng was up a good 8.66% up. Strait Times was closed. Europe decided to outdo Asia and was up 6-8%. FTSE up 6.19%, Dax 7.63% up and CAC up 8.68%. US also closed well in green inspite of the Tribune Co filing for bankruptcy. The second day continued its good run up with Europe starting the day red and climbing and closing green. FTSE was up 1.89%, Dax up 1.34% and CAC up 1.55%. US then could not sustain this everyday rally up. Finally yesterday the Dow lost 242 points to close 2.72% red, Nasdaq down 1.55% and S&P down 2.31%. In Asia today only Nikkei has opened and it opened mildly red and climbed half a percent up in green. It is too early to say where it will go.

The candle yesterday – though white was not particularly good. I would have personally preferred that it closes above 2800 or 2840 – but that was not to be and it traded well above 2800 – touched just above the R2 and then closed just below the R1 level. It was some how to be expected. There is still no faith that this run-up will last too long and there was a holiday – it could have jittered anyone. So sell off did take place but it negated the black candle of day before. The candle had a large lower body and an upper wick. As a candle however does not give a bad indication. The Bollinger bands have contracted a bit more. Red 5 EMA line is a bit closer to the 20 EMA but the crossover that I expected is still eluding us. Volumes were bit less than a day before. MACD divergence has increased a bit more and red line is comfortably above the blue line. RSI is good and bullish, it is the StochRSI that is entering the overbought zone so may be a cause of little worry. Slow Stochastic red line is comfortably above the blue line. TRIX is still facing up and looks good as ever. So seeing all this – ideally the ball should continue rolling up.

Okay – the Pivot data for the day…

Pivot data…

R3 23008 against 2941 monday

R2 2933

R1 2858

Pivot 2786 against 2745 monday

S1 2711

S2 2639

S3 2564 against 2549 monday

Projected High Range 2822 to 2896

Projected Low Range 2826 to 2752

Fib Projected High 2900

Fib Projected Low 2674

have you noticed the Pivot data – the upper R3 has moved up to above 3000 mark. Hope we touch it just for happiness sake.

Best of luck to everyone for a good day tomorrow.

Sunday, December 7, 2008

Confused yet????

Don't be -- this tango as before is to keep you >>>> the retail investor on the loosing side. See the markets were oversold... oversold... oversold and we kept standing at the same place with fairly low volumes. Inspite of all this the indicators could not be turned to show bearish times. Then there was a day of thanksgiving where the markets gave a good run up inspite of not so good global cues. Then suddenly there was a talk of markets will go up, the very next day saw good profit taking or perhaps also the build up of short positions. Again in the air was a talk of – I told you so type – we will not sustain at these high levels… I feel that they have been wrong – there would be retail investor who would have not really entered the market and in any case there would have been some who would have jittered out on friday – the way the markets showed weakness. The markets should ideally continue to go up – helped by all the announcements that are coming from the govt to help – retail, banking, finance and constructions etc. I believe that this is so orchestered that the markets keep going up for one reason or the other till the elections so that the performance looks good for the govt in chair. Hey that was hypothetical – but I am sure that this would be working in some one’s mind. Prices of petrol and diesel have been dropped – still keeping some leeway in hand to announce just a little bit more – when? Ofcourse the coming round of elections will be the time. As for the positive news now – FIIs selling is not what it was used to be. They have sold just about 4-5 crores worth on friday. Petrol is cheaper by Rs 5/- and Diesel down by Rs 2/-, Repo rate has been cut by a 100 basis points against the expected 50 to 75 points by the markets. The next phase will include rate cuts by banks – though they are seeming to be defiant – but that is the way they will go – it is just a matter of time. The real estate will also get a small lease of life – I remember listening on idiot box – a lot of builders are resisting dropping prices of real estate – they might get another few weeks / months of joy – but ultimately will once again come under pressure – it is just a matter of time once again.

The global cues are good. It was really not so but some way down the line the things changed. Nikkei opened green, went red went green and closed flat at –0.08% red. Hang Seng closed green up 2.49% and Strait Times up 0.94%. Europe opened red and went down deeper red to close at the lowest levels for the day. FTSE closed 2.74% red, Dax down 4.0% and CAC down 5.48%. US was interesting – they opened red (as expected) – traded in red for the majority of the day and then climbed all the way to close better than 3% up. Dow was up 3.09%, Nasdaq up 4.41% and S&P up 3.65%. Actually as far as US is concerned – they are bullish – but are struggling to find the pattern much like us. This may take the US markets up for a few days/weeks.

The candles are good – the Bollinger bands are still contracting and mind you the break out is yet to happen and I have a feeling that it will be a violent one – the pressure is building up. This time over the candles are along the mid of the band – give or take some and the candles look like having life enough to cross over into the upper band (mid way and above). Bollinger band had generated a buy signal on 2 1th Nov. 5 EMA line is slowly and steadily going up and will cross the 20 EMA line giving a good bullish indication. The volumes were same as before so nothing really to talk about. MACD positive move remains strong and it had generated a buy on 03 Nov. Red line is above the blue line and divergence increasing. RSI is in a bullish mode – slowly and steadily moving up. On friday inspite of it being a day in red the Slow Stochastic showed a positive move by the red line remaining above the blue line. TRIX is facing up so that remains a good indication of the times to come. Like I have being saying there will be a time to short and this is not the time.

1th Nov. 5 EMA line is slowly and steadily going up and will cross the 20 EMA line giving a good bullish indication. The volumes were same as before so nothing really to talk about. MACD positive move remains strong and it had generated a buy on 03 Nov. Red line is above the blue line and divergence increasing. RSI is in a bullish mode – slowly and steadily moving up. On friday inspite of it being a day in red the Slow Stochastic showed a positive move by the red line remaining above the blue line. TRIX is facing up so that remains a good indication of the times to come. Like I have being saying there will be a time to short and this is not the time.

Pivot data…

R3 2941 against 2775 friday

R2 2865

R1 2789

Pivot 2745 against 2653 friday

S1 2669

S2 2625

S3 2549 against 2531 friday

Projected High Range 2767 to 2827

Projected Low Range 2814 to 2754

Fib Projected High 2853

Fib Projected Low 2668

Best of luck to everyone for a good day tomorrow.

Friday, December 5, 2008

Thursday, December 4, 2008

I am sick… of this directionless market…

If it breaks upwards then I will celebrate because I was right all this while – if it goes down then atleast I will know that I was wrong. Now waiting for something to happen has become the worst thing in my life now-a-days. Even US feels so – they are so sick of the bad news and the worthless data that is pouring in that they sometimes disregard it and set it aside to show some movement. What are we waitin g for? GOD only knows. Perhaps the smartest thing possible is being done by the idiot box – they give a high target one day and a low target the other – now they have done is for so many days at a stretch that any good move – whether positive or negative they can claim it as a trophy - ‘I said so…’. Okay now – the economic data that has come out in US is bad as expected. As the data poured in about the state of the US economy the US investors shook their head in disbelief – after it was all done – the markets took a swing to higher levels as investors and analysts say that most of the bad news ahs already been priced into the markets shown by the huge declines in the past two months. There was also a news doing round in the markets that the hedge funds have stopped selling as aggressively as they were doing in the past. The news included – drop in productivity, a pullback in services and the Federal Reserve’s finding of a worsening economic conditions across the country. Two thoughts worth taking note of - the US positive streak for past nine days with the exception of Monday –Firstly, some say that the present upswing is in no way fundamental and that it is just wishful thinking. The second thought is that though the turbulence will continue – the worst is over. Take your pick for whatever it is worth.

g for? GOD only knows. Perhaps the smartest thing possible is being done by the idiot box – they give a high target one day and a low target the other – now they have done is for so many days at a stretch that any good move – whether positive or negative they can claim it as a trophy - ‘I said so…’. Okay now – the economic data that has come out in US is bad as expected. As the data poured in about the state of the US economy the US investors shook their head in disbelief – after it was all done – the markets took a swing to higher levels as investors and analysts say that most of the bad news ahs already been priced into the markets shown by the huge declines in the past two months. There was also a news doing round in the markets that the hedge funds have stopped selling as aggressively as they were doing in the past. The news included – drop in productivity, a pullback in services and the Federal Reserve’s finding of a worsening economic conditions across the country. Two thoughts worth taking note of - the US positive streak for past nine days with the exception of Monday –Firstly, some say that the present upswing is in no way fundamental and that it is just wishful thinking. The second thought is that though the turbulence will continue – the worst is over. Take your pick for whatever it is worth.

Well to the global cues not. Asia opened positive (unlike us – wonder what is wrong with us) and remained basically positive ending – Nikkei 1.79% up,Hang Seng up 1.36% up and Strait Times flat 0.08% up. Europe was negative the entire day and then by the end showed a good recovery inspite of US futures giving negative cues. FTSE was up 1.14%, Dax up 0.78% and CAC 0.44% up. The US was well into the red territory to start the day with. then with effort it moved up in green territory. As the economic data flowed in the markets plunged down – then with a few sprinkles of good news the markets bounced back in positive territory once again to end the day in green – up almost 2% +. Dow was up 2.05%, Nasdaq up 2.94% and S&P up 2.58%.

On the candles – there is just nothing that is new. The candle was almost a perfect Doji. the Bollinger bands are there where they were yesterday, the day before, the day to day before…. sorry just get carried away. The 5 EMA line is still below the 20 EMA line. Volumes a bit better than yesterday. MACD still shows a positive divergence. RSI is good and bullish. Slow Stochastic looking down with the red line still below the blue line. TRIX is still good and green looking up.

Pivot data…

R3 2775 against 2774 yesterday

R2 2735

R1 2695

Pivot 2653 against 2633 yesterday

S1 2613

S2 2571

S3 2531 against 2492 yesterday

Projected High Range 2674 to 2715

Projected Low Range 2670 to 2629

Fib Projected High 2715

Fib Projected Low 2588

Best of luck for trading today.

Wednesday, December 3, 2008

Hey don’t take the markets to be bad…..

0700hrs 03 Dec 08: US markets have ended 3 to four percent points in green. Before closing the markets looked like diving in red but recovered. Nikkei opened green but is now lower than the opening levels. Strait Times are about a percent and few points up.

02 Dec 08: The markets have actually held out the otherwise bad Global cues and non bothered govt here. Take a look at the crude – it is now a days a good barometer of where we are heading towards – crude up – stock up, crude down – stock down. Inspite of all the cues and the hype of lower targets – the markets survived and survived well. they recovered from the lows of the day – or to say the start of the day and there was actually a strong possibility that the markets would have gone green. The reason among the circles is that though is is a known fact that the production will reduce – the coming results of companies may be extremely bad – but the fact remains that the valuations at the moment are good and lower levels – see some sort of buying support that at the moment does not allow the markets to sustain fearlessly at the lower levels. It was expected that we will not break the S2 on the lower side and so it was. Today as I write the rally in US continues neutralising upto 1/3rd of the losses the markets made on maniac monday. So far so good. The second thing that pays up in mind is that the so called recession is already a year old. Does everyone really think that this will turn out to be worse than or equivalent of “The Great Depression?” – forget it! It is bad – agreed but there will be solutions too. There is a few billion people in Asia and Africa – who given the right environment will take the consumption and demand to higher levels. Take China and Indian example. You think our demand has disappeared? It is lurking and will pop up given the right environment. I may not really approve of it but the Auto bailout plan in US seems to be around the corner and that would give another boost to the markets for once. Eventually we may fall – okay but at the moment all the indicators are pointing up.

Inspite of all the cues and the hype of lower targets – the markets survived and survived well. they recovered from the lows of the day – or to say the start of the day and there was actually a strong possibility that the markets would have gone green. The reason among the circles is that though is is a known fact that the production will reduce – the coming results of companies may be extremely bad – but the fact remains that the valuations at the moment are good and lower levels – see some sort of buying support that at the moment does not allow the markets to sustain fearlessly at the lower levels. It was expected that we will not break the S2 on the lower side and so it was. Today as I write the rally in US continues neutralising upto 1/3rd of the losses the markets made on maniac monday. So far so good. The second thing that pays up in mind is that the so called recession is already a year old. Does everyone really think that this will turn out to be worse than or equivalent of “The Great Depression?” – forget it! It is bad – agreed but there will be solutions too. There is a few billion people in Asia and Africa – who given the right environment will take the consumption and demand to higher levels. Take China and Indian example. You think our demand has disappeared? It is lurking and will pop up given the right environment. I may not really approve of it but the Auto bailout plan in US seems to be around the corner and that would give another boost to the markets for once. Eventually we may fall – okay but at the moment all the indicators are pointing up.