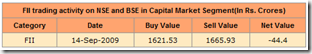

Hey guys am I missing something or there is some error in the FII and DII data? It has been ripped out from directly from the NSE site so I presume that the data presented is correct and the FIIs continue to be net sellers. Did it mean that after the FIIs had done with their selling the DIIs threw in whatever they could to save the markets from the massacre? I really do not have answers for this and neither did I find any solutions. In any case it has been my experience that not all share their experience or let us say knowledge – may be they are more busy making money.

Hey guys am I missing something or there is some error in the FII and DII data? It has been ripped out from directly from the NSE site so I presume that the data presented is correct and the FIIs continue to be net sellers. Did it mean that after the FIIs had done with their selling the DIIs threw in whatever they could to save the markets from the massacre? I really do not have answers for this and neither did I find any solutions. In any case it has been my experience that not all share their experience or let us say knowledge – may be they are more busy making money.

The global cues are against the markets at the moment – let us start from one side. Asia was what we saw and reacted to – it was the colour of blood. Nikkei down 1.42%, Hang Seng Down 3.03% and Strait Times down 1%. Europe took cues from that and opened flat and fell, soon the markets there however started to improve and continued to go higher finishing at the highest for the day. Of course the US trend laid the path for the upswing. The US too started flat but soon went on to touch new highs – now in md session trading flat at around their best levels. Dow as of now is 1.25% up, Nasdaq up 1.64% and S&P up 1.21%. I am enclosing the write up from the Yahoo finance that I find it important that you go through and know what is happening.

I quote…

Stocks jumped in light trading Wednesday as investors awaited the Federal Reserve's interest rate announcement. Major stock market indicators rose more than 1 percent, including the Dow Jones industrial average, which gained 120 points to reverse a sharp slide Tuesday.

Stocks jumped in light trading Wednesday as investors awaited the Federal Reserve's interest rate announcement. Major stock market indicators rose more than 1 percent, including the Dow Jones industrial average, which gained 120 points to reverse a sharp slide Tuesday.

For months, investors have been looking for evidence that the economy is strengthening and pulling out of recession. Traders pay particular attention to the Fed's assessments of the economy. The latest is due at 2:15 Eastern when the central bank concludes a two-day meeting on interest rates.

It is widely expected that the central bank will hold the federal funds rate near zero. What investors are uncertain about it how the Fed will size up the economy -- whether it sees further signs of strengthening that would justify the gains in stocks since the spring.About four stocks rose for every one that fell on the New York Stock Exchange, where volume came to 439.1 million shares, compared with 503.4 million shares traded Tuesday. Light volume price moves and could be overstating investors' enthusiasm ahead of the Fed decision.The market is bouncing back a day after posting its biggest loss in five weeks. The Dow slid 1 percent and the S&P 500 index lost 1.3 percent. (Source: Click Here)

It is widely expected that the central bank will hold the federal funds rate near zero. What investors are uncertain about it how the Fed will size up the economy -- whether it sees further signs of strengthening that would justify the gains in stocks since the spring.About four stocks rose for every one that fell on the New York Stock Exchange, where volume came to 439.1 million shares, compared with 503.4 million shares traded Tuesday. Light volume price moves and could be overstating investors' enthusiasm ahead of the Fed decision.The market is bouncing back a day after posting its biggest loss in five weeks. The Dow slid 1 percent and the S&P 500 index lost 1.3 percent. (Source: Click Here)

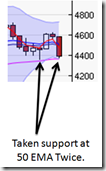

Coming to my favourite – the technicals. The candle was a hammer and purely from the candles point of view it can signal a reversal – reversal from the present downtrend. But also importantly it the candle just shied a dot short of hitting 50 EMA running at 4342. The 3 EMA remains firmly below the 15 EMA and as of today also crashed below the 20 EMA standing on top of 25 EMA exactly at 4471. SO on that account the bears should not really loose their sleep. The volumes were still low. The ADX has improved by a point to be at 17 – but that too is weak still. MACD is still bearish and the divergence has increased – mind you. RSI is at 49.7 and today too I will disregard it as a bearish crossover. We will give it another day. TRIX is looking down and Slow Stochastic while still remaining in oversold territory has generated a buy signal. Very fairly and squarely we remain bearish as far as the technicals are concerned. What you also see in this chart on the left is the dots of the Parabolic SAR (10, 2 , 20). They too are red as of now.

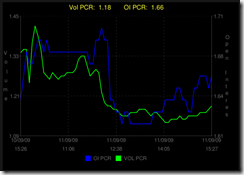

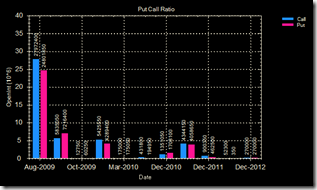

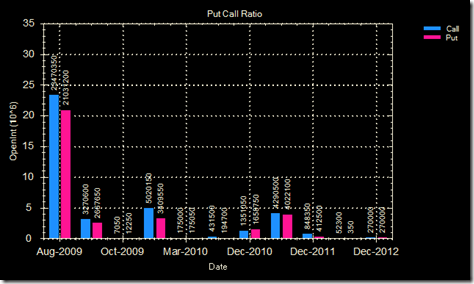

The options data has no change so the Put call remains a shade below 1. So all in all the Global cues are likely to remain strong in view of the Fed meet outcome. The Hammer and Slow Stochastic can signal bullish run whereas ADX, MACD, TRIX continue to signal bearish undertones. Options are not likely to play a role except the 4700 being a strong reistance upwards.

| Indicator | Bullish/Bearish | Sell/Buy Signal | Nifty Level at signal | Points gained / lost since (4457) | Remarks |

| Harami | - | - | - | - | Signal has played it part and buried |

| Hammer | Bullish (reversal) | - | - | - | |

| 315 Strategy | Bearish | Sell / 10 Aug | 4437 | (-) 20 | |

| ADX | Bearish | Sell / 07 Aug | 4481 | + 24 | |

| MACD | Bearish | Sell / 10 Aug | 4437 | (-) 20 | |

| RSI | - | - | - | - | Disregarding – waiting for a clearer indication |

| Slow Stochastic | Bullish | Buy / 12 Aug | 4457 | 0 | |

| Options | Neutral | - | - | - | |

So we might be reaching the stage where it might be wise to sit on sidelines especially if the market close in green. All the same the best strategy as of now would be to remain short. Do keep a stoploss for the shorts at 4516 on closing and if you are long then do not hold if the market closes below 4386. For the day – if market is above 4483 – go long and below it go short. Best of luck to everyone for tomorrow.

Explanation given by ID Stockstar for my first Paragraph on ‘Stockezy’ on 12 Aug:

Well cash selling many times used just as one way of doing cross arbitrage!

Like when nf shorted at 4700 level with call writing done and put buying done....also stock future shorting done.......so only thing that remains is using cash stocks to bring it down....so cash basket selling used to help make all 3 trades in profit. now question remains what happens to cash stocks......if they want to keep trend up they just buy more stock futures at bottom and reverse nf future and option positions.....and now how to take nifty uppppppp take it up with spot cash buying in nifty stocks and nifty future buying!

If u see all data in toto for last 10 days u can make out!

TO highlight more.....when nf was at 4700 for three days nf was rising with lower nf future volume and stock future short positions were added up and call writing was on.....more so in medium term nifty calls like sept and nf was waiting to dip yesterday nearly all positions started reversing hence thats reason for strong pullback today as they defend lower put writing very well in closing!

Hence now swing trade wise unless 4350 breaks in closing basis trend is up!