It had been an unexpected day yesterday (like a long time now) when markets – expected to correct somewhat. What the markets are doing is that it is looking around for direction that is not available as of now. Take is this way that the markets want to correct as most of the indicators are overbought – but cannot do so as the environment is bullish. This makes us to be basically unsure with a bullish undertone. There is a question that is haunting my mind and am sure a lot of minds like mine – where are we off to now?

What is driving Our markets can be a good question at this stage. Is it only the FII money pouring in or we have the retail lining up for a mad rush? We can see from this table that I have inserted about the FII/DII data that FIIs are buying and DIIs are net sellers. But also see that a positive volumes of 350 Cr has actually moved the markets (Nifty) up by just 14 odd points on closing. Does it mean that the FIIs are moving on to the second tier of stocks? FIIs who are continuing to buy on our bourses or the DIIs who are modestly selling almost every day.

The global cues cannot be better than the one we are having at the moment. Asia closed up – Nikkei up 1.02%, Hang Seng 0.96% in green and Strait Times up 1.40% in green. The Europe opened green and then traded in a fairly narrow band. however just after mid session the European markets jumped up – was unable to sustain and closed somewhat off their highs. FTSE closed 1.18% in green, DAX up 0.24% and CAC up 0.82%. The barometer of the world economy – US opened in green and went on to touch the flat line – spiked up and then closed flat. DOW up 0.15%, Nasdaq down 0.03% and S&P down 0.25%. We will have to wait a while for the markets to open.

The markets have continued on a rally for an unstoppable 13th straight week and the sentiments more than anything else have paved this way. The economic data that has been released from US, Germany, UK, Japan and China indicates towards a gradual recovery – more than recovery perhaps is the indication that the downside has bottomed. All participants are now worried about the direction of the markets and many are not fully convinced that there is a further upside to this levels. On the other hand the downside has on the previous occasions also been limited when the markets wanted to correct due to the buying that prevents any sharp fall. There is important global economic data that is due and that might show direction in the coming week.

- Unemployment in Europe continues rising.

- US home sales seem to be stabilising as the mortgage interest rates are at its lowest.

- Euro GDP has contracted just 2.5% for the fourth consecutive quarter (improvement over the contraction of 4.8% in first quarter of 2008)

- UPA is to shortly unveil its disinvestment agenda with a target of 10,000 Cr for a 12 month period.

- In order to check the dominance of Gail and Reliance in the gas transmission segment the govt has planned to take up all the main gas pipeline projects to ensure their speedy implementation.

- Our growth rate has come down to 5.8% for the fourth quarter of 2008-09 and 6.7% for the entire year – much better than expected.

The gold has remained positive but stable but the crude has risen more than 6%. This will eventually put pressure on the govt and may result in some bad news either way. What I mean is that if the prices are unchanged then the investors following the markets may be susceptible and if they do change then the change is too close to the election that have gone buy and might be easy to mudsling on the govt.

On the charts the candle once again was a small white one. Maybe it is showing more confusion than anything else. We are on the upper half of the Bollinger Bands but not the top. 3 EMA and the 15 EMA are as of now running parallel to each other. Both lines are on their way up so a crossover – unless there is a strong negative move is not likely to happen. Volumes have remained to be good. The ADX line has turned from near the 20 mark to look up now at 38.18. The green line that had briefly crossed below the red line is seeming confident. MACD divergence is very small – but positive (bullish). Slow Stochastics are overbought and bearish at the moment. RSI continues to be overbought at 77.05. All in all – the bullish signals overweigh but there are strong signals of markets being overbought.

I think that Pivot data should be presented now.

R3 4711

R2 4669

R1 4627

Pivot 4594

S1 4552

S2 4519

S3 4477

Projected High Range 4611 to 4648

Projected Low Range 4623 to 4586

Fib Projected high 4656

Fib Projected low 4540

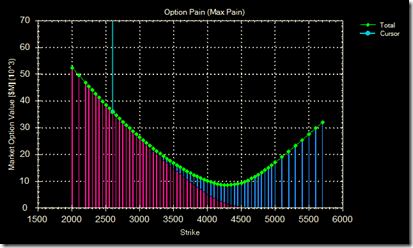

And finally the option pain and Put Call ratio…

![clip_image001[1] clip_image001[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjMsahr0OGsdLjR3BOU1ls_-QRmjhyphenhyphenmr5ioXwQgzpEfCvb_hasHPf3Xs4sWRkNYjaCN5JyvGo_QxbYtN9yYy6DWhWuJq4_7HU6zqrToIL6FdCWWEmIOkT2vitl42NNQn4_mF5SidjAgcpex/?imgmax=800)

5 comments:

paaji good mrng,

welcome back to mkts...by the way..RSI is 67 not 77..i double checked with excel and icharts(auto updating chart),but manual update is wrong...

take care...

paaji monsoon is here..so be sober...(hic!!)

Hi jaggu - i am still on my chutti binge - till 13th of this month - this update is to thank some good soul who clicked some magical add that gave me 5$ in a day.

And thanks for the RSI - bloody iCharts - always want to confuse me...

cheers

cheema

Paaji:

Great to see you back! Aapne aate hi market mein gul khila diya.

:)

:) hi cheema

Post a Comment