Every problem is being brushed aside under the carpet – the bulls seems to be in love with themselves and the bears are too weak to strike. Like I said in an update a few days back – whenever there is a run up we do not know whether the bulls are taking a breather or the bears are polishing their nails for a strike. Yesterday – can be anything – any of the above two choices. The analysts in US and Europe are shouting on top of their voice that the US and European markets are cheaper than the emerging markets – do not disregard it if this idea catches on.

As far as the global cues are concerned they are cautiously mixed. In Asia nikkei was up 0.22%, Hang Seng down 0.05% and Strait Times down 1.23%. Europe was down near the flat line. FTSE was down – 0.24%, DAX down 0.18% and CAC down 0.04%. US started red but after ups and downs ended green. Dow was up 0.36%, Nasdaq up 0.13% and S&P up 0.30%. US is out surprising everyone with a steady recovery in one sector after another – maybe we will not call it recovery but will say that the worse may seem to be over. Asia too is not doing too well today – Nikkei down just 0.08%, Hang Seng up 0.41% and Strait Times up 0.38%.

As far as the global cues are concerned they are cautiously mixed. In Asia nikkei was up 0.22%, Hang Seng down 0.05% and Strait Times down 1.23%. Europe was down near the flat line. FTSE was down – 0.24%, DAX down 0.18% and CAC down 0.04%. US started red but after ups and downs ended green. Dow was up 0.36%, Nasdaq up 0.13% and S&P up 0.30%. US is out surprising everyone with a steady recovery in one sector after another – maybe we will not call it recovery but will say that the worse may seem to be over. Asia too is not doing too well today – Nikkei down just 0.08%, Hang Seng up 0.41% and Strait Times up 0.38%.

On the charts we have had a ‘Bearish Harami’ I think for all whose who do not know about it an explanation is necessary. It is a small black candle that is engulfed in a long white candle the previous day. Harami in Japanese is akin to pregnant or so I gather. Please do note that this is a good reversal signal provided the next day ends below the black candle of yesterday.

It is a small black candle that is engulfed in a long white candle the previous day. Harami in Japanese is akin to pregnant or so I gather. Please do note that this is a good reversal signal provided the next day ends below the black candle of yesterday. Ideally it should lead to this second black candle today.

Ideally it should lead to this second black candle today.

Psychology...

A long 1st day with high volume in the existing uptrend brings complacency to the bulls. The next day trades in a small range within the previous day's real body. Light volume on the 2nd day should give rise to concern by the bulls of an impending change of trend. Look for lower prices over the coming days, especially if the next day provides confirmation of a trend change by closing lower.

Beyond that as expected the markets are not really going on to trail the upper Bollinger Band so the middle of the bands should ba the next target. As afar as the EMAs are concerned they still remain bullish and I would have loved to see 4634 broken for a bearish indication. Anyway there is always today for it to happen. The volumes were 94% of last 50 day average. The ADX on iCharts is about to substantiate and give strength to the bulls but on my software the value is 18 so I will stick to this as a weak trend. MACD is bullish and the Divergence was good. RSI is bullish and at 64 – cannot really classify it as overbought. Slow Stochastic is still bullish but overbought and this is almost 14th day it has been overbought. I think if we are not in a classical bull run then we should correct now. TRIX still looks up.

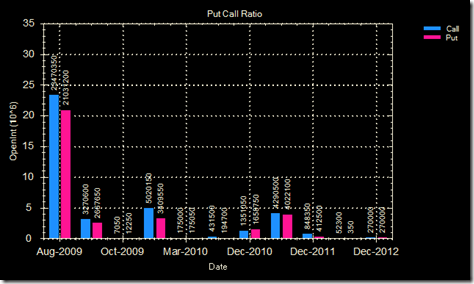

On options data there is no change of significance really. So to summarise. Global cues mixed to mildly bullish. Candle bearish if supported with a black candle today. ADX shows caution for this uptrend and Slow Stochastic overbought. Rest all bullish. Options will give mild resistance for the markets to fall. For past I have been experimenting with how to put across a summary and yesterday I made one table and put it up – today I am trying to put across another table. If you care do let me know which one is better so that we have a reference to the past. All are with reference with Nifty.

| Indicator | Bullish/Bearish | Sell/Buy signal generated on | Nifty level at signal | Points gained/lost since

(4681) | Remarks |

| Harami | Bearish | Sell / 04 Aug | | -- | Will review after seeing the candle today |

| ADX | Bullish (weak) | Buy / 14 Jul | 4111 | + 570 | |

| MACD | Bullish | Buy / 16 Jul | 4231 | + 450 | |

| RSI | Bullish | Buy / 16 Jul | 4231 | + 450 | crossover 50 |

| MACD | Bullish | Buy / 17 Jul | 4375 | + 306 | (overbought now) |

Sorry Guys just realised that making the above table takes hell lot of a time so might not be able to follow it everyday – all the same the suggestions are welcome. See the above and place the trust on technicals and not your heart. Discipline at the end will matter. Cheers