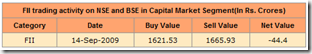

Like I said yesterday – it is not that the confusion is there in our minds only – it is there everywhere and no one really knows where, how and when we are headed too. That we have to go somewhere is – but inevitable. What is probably happening is that the positions are taken with a hope that the markets will go somewhere (mostly on the bearish side) and when the markets do not do anywhere there is a rush to square off the positions with a fear for carrying positions overnight and the markets then return to the start point. That would be a fair assumption why we are not going anywhere. Top this with dismal FII and DII interest – we are back to the start really with nothing happening. And at the cost of a repetition – it is not confined to our markets. It is happening everywhere. Look at Asia, Europe – US anywhere – the markets just not decided after moving up so much – where to go to.

Like I said yesterday – it is not that the confusion is there in our minds only – it is there everywhere and no one really knows where, how and when we are headed too. That we have to go somewhere is – but inevitable. What is probably happening is that the positions are taken with a hope that the markets will go somewhere (mostly on the bearish side) and when the markets do not do anywhere there is a rush to square off the positions with a fear for carrying positions overnight and the markets then return to the start point. That would be a fair assumption why we are not going anywhere. Top this with dismal FII and DII interest – we are back to the start really with nothing happening. And at the cost of a repetition – it is not confined to our markets. It is happening everywhere. Look at Asia, Europe – US anywhere – the markets just not decided after moving up so much – where to go to.

Let us look at the global cues – Asia was all red and deep red (except us of course ;’-D ) Nikkei was down 2.3%, Hang Seng was down 1.08% and Strait Times was down 1.54%. Moving on to Europe they too opened with deep cuts but then went on to recover (something like us) FTSE finally closed 0.15% up in green, DAX down 0.07% and CAC down 0.11%. US is facing major concerns on the US-China trade terms and opened lower but as of now – just short of the mid session is hovering around the unchanged line – Dow in red 0.16%, Nasdaq down 0.04% and S&P down 0.03%. The way the things stand – the markets can make a recovery also – so will have to review again tomorrow.

Let us look at the global cues – Asia was all red and deep red (except us of course ;’-D ) Nikkei was down 2.3%, Hang Seng was down 1.08% and Strait Times was down 1.54%. Moving on to Europe they too opened with deep cuts but then went on to recover (something like us) FTSE finally closed 0.15% up in green, DAX down 0.07% and CAC down 0.11%. US is facing major concerns on the US-China trade terms and opened lower but as of now – just short of the mid session is hovering around the unchanged line – Dow in red 0.16%, Nasdaq down 0.04% and S&P down 0.03%. The way the things stand – the markets can make a recovery also – so will have to review again tomorrow.

As far as the technicals are concerned the candle was a red one – the entire day played out in a narrow zone only with a short covering helped attempt to recovery.The market momentum definitely seems to be tapering off on the charts. The volumes are low and the chances after today have brightened to visit middle Bollinger bands. TRIX is bullish and so is MACD and RSI. Slow Stochastic have come out of the overbought condition but are bearish as of now. All in all – nothing much is happening. ADX too seems bullish at the moment.

As far as the technicals are concerned the candle was a red one – the entire day played out in a narrow zone only with a short covering helped attempt to recovery.The market momentum definitely seems to be tapering off on the charts. The volumes are low and the chances after today have brightened to visit middle Bollinger bands. TRIX is bullish and so is MACD and RSI. Slow Stochastic have come out of the overbought condition but are bearish as of now. All in all – nothing much is happening. ADX too seems bullish at the moment.

The options data is roaming around at the same place so I will not spend time to dwell upon it too much. The PCR is 1.81 and that is the expectations of the majority speaking that the market will fall – or let us put it this way that the markets should fall. The writers of Puts will not like that situation obviously so we can still wait out for a major fall to come our way.

All in all the trend so far remains bullish and for those long do not hold longs if the markets are likely to close below 4795 those in the bear camp who are short should not hold shorts if the markets are likely to close above 4859. For the day be long above 4807 and short below this level.

May you all make money. Good luck!

5 comments:

get Free Stock Tips and Commodity Tips Visit Capitalvia Blo

I absolutely adore reading your blog posts, the variety of writing is smashing.This blog as usual was educational, I have had to bookmark your site and subscribe to your feed in ifeed. Your theme looks lovely.Thanks for sharing.

Regards

Stock Tips

thanks for this post. This post makes a great point about focusing your efforts.

free stock tips,equity tips,bse,nse | Currency Tips,Forex trading Tips,Forex Pairs

No matter if you are stock market trader or investor, You need to be very careful while dealing in Indian stock market. Stock market offers huge returns but many less people are able to stay in profit just think why? Is it because of lack of share trading knowledge? Well let’s discuss this in this nice blog and see what everyone has to say about it. Come one let’s start a discussion which will benefit lot of stock market traders and investors.

This is such a great resource that you are providing and you give it away for free.I love seeing

websites that understand the value of providing a quality resource for free.It’s the old what goes around comes around routine.Big thanks for the useful info.

Post a Comment